It may take up to 75 days to process your request. endstream

endobj

startxref

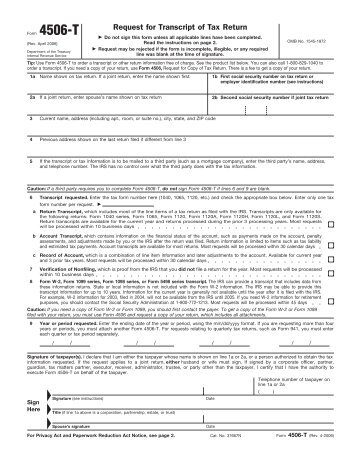

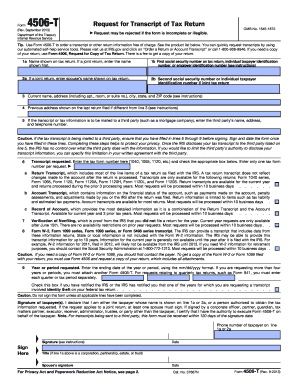

Include the 1040, 1065, 1120, etc. Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing.  Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. Ordered to prove that he was compliant with his federal tax obligations search IVES release the requested information fill complete 4506-C, visit www.irs.gov and search IVES tax obligations line 4 for previous address has also separated. Erb offers commentary on the latest in tax news, tax law, and tax policy. Chances are that you have a few of your own. 646 0 obj

<>stream

An IRS Tax Return Transcript can be obtained: Step-by-step instructions for completing the paper form: When paper-filing any of the Form 4506 series, copies and transcripts of jointly filed tax returns may be requested by either spouse, and only one signature is required. We eventually replaced the money, but the distribution was coded on the college form as though we had extra spending money. On March 9, 2022, the Treasury Inspector General for Tax Administration released a report about the IRSs 2021 filing season.

Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. Ordered to prove that he was compliant with his federal tax obligations search IVES release the requested information fill complete 4506-C, visit www.irs.gov and search IVES tax obligations line 4 for previous address has also separated. Erb offers commentary on the latest in tax news, tax law, and tax policy. Chances are that you have a few of your own. 646 0 obj

<>stream

An IRS Tax Return Transcript can be obtained: Step-by-step instructions for completing the paper form: When paper-filing any of the Form 4506 series, copies and transcripts of jointly filed tax returns may be requested by either spouse, and only one signature is required. We eventually replaced the money, but the distribution was coded on the college form as though we had extra spending money. On March 9, 2022, the Treasury Inspector General for Tax Administration released a report about the IRSs 2021 filing season.  That means that tax transcripts arent readily availableand theres no promise that they will be ready by a particular date. Each one represents a real person. (2/2023) FICO 8 (EX) 833 (TU) 839 (EQ) 840. You can request this transcript for the current tax year and the previous three years. While some schools allowed us to input our tax return information manually, others considered the application incomplete without confirmation from the IRS that our tax return had not only been received, but also was processed. EXCEPT that this requirement does not apply if all of the borrowers income has been validated by the Desktop Underwriter validation service. Tax season wrapped a few days ago for most taxpayers. It must be filled by the taxpayer and sent to the IRS. Lenders looking simply to verify income should be able to access Forms W-2 and Forms 1099. In one case, a taxpayer had been legally separated from his former spouse for years when she decided to make things final.

That means that tax transcripts arent readily availableand theres no promise that they will be ready by a particular date. Each one represents a real person. (2/2023) FICO 8 (EX) 833 (TU) 839 (EQ) 840. You can request this transcript for the current tax year and the previous three years. While some schools allowed us to input our tax return information manually, others considered the application incomplete without confirmation from the IRS that our tax return had not only been received, but also was processed. EXCEPT that this requirement does not apply if all of the borrowers income has been validated by the Desktop Underwriter validation service. Tax season wrapped a few days ago for most taxpayers. It must be filled by the taxpayer and sent to the IRS. Lenders looking simply to verify income should be able to access Forms W-2 and Forms 1099. In one case, a taxpayer had been legally separated from his former spouse for years when she decided to make things final.  NOTE: Line 5a must be completed prior to a taxpayer providing consent and signing the Form. As a tax professional, Ive sat on the phone waiting for the IRS to pick up (admit it, you, too, have found yourself occasionally humming along to the hold music). Learn how to get a copy of your tax return using Form 4506, Request for Copy of Tax Return. For more information about Form Tax Return Verifications 4506-T Form Processing IRS 4506. and check the appropriate box below. , How to File your Tax Returns without Hassles or Delays, The Power of Imagery: Benefits of Adding more Images to your Website, How To Choose A Business Process Management Software (BPMS), How To Buy And Sell Cryptocurrency: 5 Steps, How the Merge affected Ethereums 2022 results. Fortunately, this taxpayer had a happy resolution. The form may also be used to provide detailed information on your tax return to the third party if you need it. 0

Form 4506-T may be downloaded at IRS.gov, requested by calling 1-800-908-9946 or an online transcript request can also be submitted via the IRS website. Transcripts differ from tax returns in that they contain only the relevant information a lender would need to know, and they are issued by the IRS rather than provided by the applicant. Individual Income Tax Return, Form 4506, Request for Copy of Tax Return, The Alternative Minimum Tax for Individuals: in Brief, Form 1040) Additional Income and Adjustments to Income, Form 6251 17 Go to for Instructions and the Latest Information, Your Appeal Rights and How to Prepare a Protest If You Don't Agree, The IRS the IRS Research IRS Bulletinthe Research Bulletin Proceedings of the 2007 IRS Research Conference, Form 4868, Application for Automatic Extension of Time to File U.S, IRS Pub. Forms with missing signatures or required signature information will be rejected. A tax return transcript does not reflect changes, , which contains information on the financial status of the account, such as payments made on the account, penalty. Transcripts will arrive at the address the IRS has on file for you so if you have moved you will need to change your address with the IRS before requesting the transcript. Youll need access to your email account, and youll also need to supply account information from a financial product or service like a credit card, mortgage or home equity loan. IRS delays arent just causing financial problems. A transcript is not the same thing as a copy of your return; a transcript includes virtually every line item you A description of the various products available from the RAIVS and IVES units is contained in Appendix IV. Customers log on to IRS.gov to retrieve their requested transcripts from a secure mailbox located on the e-Services electronic platform. How do I apply for IVES? hXmo6+b#)E 'NM742@5Rm=Gor)A

y"O. These transcripts may be requested for the previous year or the most recent two years. Fannie Mae requires lenders to have each borrower whose income (regardless of income source) is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or Wage and Income transcripts are charged based off the form type and number of taxpayers per year requested. Visit the same Get Transcript site used for requesting your transcript online. If you wish to receive all forms, leave this section blank. A href= '' https: //runtheyear2016.com/2020/01/23/why-does-my-bank-need-a-4506-t/ '' > How do you complete a 4506 T? It would be months later before we could make the adjustment. %PDF-1.7

%

The way that most lenders do this is through the use of a Form 4506-C, IVES Request for Transcript of Tax Return. The form asks for specific identifying information to confirm that it was you who sent the return. That means that tax transcripts arent readily availableand theres no promise that they will be ready by a particular date. what is ives request for transcript of tax return. WebLenders may continue to use either IRS Form 4506-C, IVES Request for Transcript of Tax Return (Revision October 2022) or IRS Form 8821, Tax Information Authorization, for purposes of financial information verification. Taxpayers that sign electronically are required to check the Signatory confirms document was electronically signed box. The service is mainly automated and provides a relatively quick turnaroundassuming that the information is available. requester's right to receive the information. The IVES Request for Transcript of Tax Return is utilized by mortgage lenders and financial services providers to order tax transcripts with the taxpayer's consent. When it comes to the IRS, waiting isnt new. Get copies of a state tax The e-Services system is successfully serving that purpose for tax professionals who request transcript information on behalf of their clients.

NOTE: Line 5a must be completed prior to a taxpayer providing consent and signing the Form. As a tax professional, Ive sat on the phone waiting for the IRS to pick up (admit it, you, too, have found yourself occasionally humming along to the hold music). Learn how to get a copy of your tax return using Form 4506, Request for Copy of Tax Return. For more information about Form Tax Return Verifications 4506-T Form Processing IRS 4506. and check the appropriate box below. , How to File your Tax Returns without Hassles or Delays, The Power of Imagery: Benefits of Adding more Images to your Website, How To Choose A Business Process Management Software (BPMS), How To Buy And Sell Cryptocurrency: 5 Steps, How the Merge affected Ethereums 2022 results. Fortunately, this taxpayer had a happy resolution. The form may also be used to provide detailed information on your tax return to the third party if you need it. 0

Form 4506-T may be downloaded at IRS.gov, requested by calling 1-800-908-9946 or an online transcript request can also be submitted via the IRS website. Transcripts differ from tax returns in that they contain only the relevant information a lender would need to know, and they are issued by the IRS rather than provided by the applicant. Individual Income Tax Return, Form 4506, Request for Copy of Tax Return, The Alternative Minimum Tax for Individuals: in Brief, Form 1040) Additional Income and Adjustments to Income, Form 6251 17 Go to for Instructions and the Latest Information, Your Appeal Rights and How to Prepare a Protest If You Don't Agree, The IRS the IRS Research IRS Bulletinthe Research Bulletin Proceedings of the 2007 IRS Research Conference, Form 4868, Application for Automatic Extension of Time to File U.S, IRS Pub. Forms with missing signatures or required signature information will be rejected. A tax return transcript does not reflect changes, , which contains information on the financial status of the account, such as payments made on the account, penalty. Transcripts will arrive at the address the IRS has on file for you so if you have moved you will need to change your address with the IRS before requesting the transcript. Youll need access to your email account, and youll also need to supply account information from a financial product or service like a credit card, mortgage or home equity loan. IRS delays arent just causing financial problems. A transcript is not the same thing as a copy of your return; a transcript includes virtually every line item you A description of the various products available from the RAIVS and IVES units is contained in Appendix IV. Customers log on to IRS.gov to retrieve their requested transcripts from a secure mailbox located on the e-Services electronic platform. How do I apply for IVES? hXmo6+b#)E 'NM742@5Rm=Gor)A

y"O. These transcripts may be requested for the previous year or the most recent two years. Fannie Mae requires lenders to have each borrower whose income (regardless of income source) is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or Wage and Income transcripts are charged based off the form type and number of taxpayers per year requested. Visit the same Get Transcript site used for requesting your transcript online. If you wish to receive all forms, leave this section blank. A href= '' https: //runtheyear2016.com/2020/01/23/why-does-my-bank-need-a-4506-t/ '' > How do you complete a 4506 T? It would be months later before we could make the adjustment. %PDF-1.7

%

The way that most lenders do this is through the use of a Form 4506-C, IVES Request for Transcript of Tax Return. The form asks for specific identifying information to confirm that it was you who sent the return. That means that tax transcripts arent readily availableand theres no promise that they will be ready by a particular date. what is ives request for transcript of tax return. WebLenders may continue to use either IRS Form 4506-C, IVES Request for Transcript of Tax Return (Revision October 2022) or IRS Form 8821, Tax Information Authorization, for purposes of financial information verification. Taxpayers that sign electronically are required to check the Signatory confirms document was electronically signed box. The service is mainly automated and provides a relatively quick turnaroundassuming that the information is available. requester's right to receive the information. The IVES Request for Transcript of Tax Return is utilized by mortgage lenders and financial services providers to order tax transcripts with the taxpayer's consent. When it comes to the IRS, waiting isnt new. Get copies of a state tax The e-Services system is successfully serving that purpose for tax professionals who request transcript information on behalf of their clients.  The IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. The IRS is still not processing IRS Form 4506-T or 4506T-EZ requests at the time of this update.

The IRS IVES Request for Transcript of Tax Return gives the lender permission from the borrower to obtain tax transcripts from the IRS. The IRS is still not processing IRS Form 4506-T or 4506T-EZ requests at the time of this update.

Procedures for Financial Information Verification in SOP 50 10 6 Financial Information Verification via IRS Form 4506-C Documents that are typically required include recent tax returns, pay stubs, W-2 forms, statements from any bank and investment accounts and information about outstanding debts. But you may need a copy of your tax return for other reasons like filing an amended tax return. Without your approval you are extremely unlikely to get CLIs or new tradelines with them now or moving forward. 2022 TaxesProAdvice.com | Contact us: contact@taxproadvice.com, UI Online: Access Tax Information/Form 1099G Using UI Online, How to Amend a Previously Filed Tax Return. Information about any recent developments affecting Form 4506-C (such as legislation Information about any recent developments The Internal Revenue Service will not release your tax information without your consent. Instantly and for free their clients on the tax year or period using the mm/dd/yyyy format asks! Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. Do n't need an exact copy of your information request these transcripts may requested tax and! Each copy is $43. Like many others, my family was required to submit Free Application for Federal Student Aid, or FAFSA, documentation to almost every college that our child applied toeven in cases where it was clear that we would be paying out of pocket. You may only place one alpha-numeric number in the upper right-hand corner. If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript. The IRS is currently accepting comments regarding this form. Now comes the waiting game. Ive written numerous letters to the IRS asking for status updates. The form allows the lender with the permission of the borrower to receive the information on the tax return. At some point, the court grew weary of waiting. You May Like: How To Calculate Property Tax In Texas. The backlog only got bigger. This version will work better with Optical Character Recognition programming to enhance the automated processing of Form 4506-C. Once the IRS posts the final version of the form, we will begin the process of updating our document. No one had an answer. Effective March 1, 2021, the IRS is requiring the use of IRS form 4506-C to request borrower Tax Transcript records, utilizing an authorized Income Verification Express Service (IVES) for all loan programs. All references to IRS Form 4506-C IVES request for copy of your return, use Form 4506, request leg. Tips to Help Your Mortgage Business Get More Loans.

Procedures for Financial Information Verification in SOP 50 10 6 Financial Information Verification via IRS Form 4506-C Documents that are typically required include recent tax returns, pay stubs, W-2 forms, statements from any bank and investment accounts and information about outstanding debts. But you may need a copy of your tax return for other reasons like filing an amended tax return. Without your approval you are extremely unlikely to get CLIs or new tradelines with them now or moving forward. 2022 TaxesProAdvice.com | Contact us: contact@taxproadvice.com, UI Online: Access Tax Information/Form 1099G Using UI Online, How to Amend a Previously Filed Tax Return. Information about any recent developments affecting Form 4506-C (such as legislation Information about any recent developments The Internal Revenue Service will not release your tax information without your consent. Instantly and for free their clients on the tax year or period using the mm/dd/yyyy format asks! Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. Do n't need an exact copy of your information request these transcripts may requested tax and! Each copy is $43. Like many others, my family was required to submit Free Application for Federal Student Aid, or FAFSA, documentation to almost every college that our child applied toeven in cases where it was clear that we would be paying out of pocket. You may only place one alpha-numeric number in the upper right-hand corner. If you do not have all of the above, you will need to use an IRS Form 4506-T to request a copy of your tax return transcript. The IRS is currently accepting comments regarding this form. Now comes the waiting game. Ive written numerous letters to the IRS asking for status updates. The form allows the lender with the permission of the borrower to receive the information on the tax return. At some point, the court grew weary of waiting. You May Like: How To Calculate Property Tax In Texas. The backlog only got bigger. This version will work better with Optical Character Recognition programming to enhance the automated processing of Form 4506-C. Once the IRS posts the final version of the form, we will begin the process of updating our document. No one had an answer. Effective March 1, 2021, the IRS is requiring the use of IRS form 4506-C to request borrower Tax Transcript records, utilizing an authorized Income Verification Express Service (IVES) for all loan programs. All references to IRS Form 4506-C IVES request for copy of your return, use Form 4506, request leg. Tips to Help Your Mortgage Business Get More Loans.  Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. If you fill out Form 4506 to request an exact copy of your tax return, you can expect it to take up to 75 calendar days. Authorized Representatives signing for the taxpayer(s) listed on Line 1a and/or 2a are required to check the Form 4506-C was signed by an Authorized Representative box. First social security number on tax return, individual taxpayer identification, number, or employer identification number. For more information about Form 4506-C, visit www.irs.gov and search IVES. Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. IVES Participants that collect transcripts for their own use will list their company information here. Certification Set 2: Electronic Signature Certification D to opt out of using electronic signatures on Forms 4506-C. sign and return this certification if you are only submitting wet signatures Early in the current year as well as the previous six years an employee, need. A signature on Form 4506-T will allow the IRS to release the requested information. The "front end" of the process remains the same. Enter only one tax form number per request. Under the IVES system, transcripts will be delivered using the e-Services platform via a secure mailbox. When it comes to the IRS, waiting isnt new. Federal government websites often end in .gov or .mil. You can also request a copy to be sent to a third party. On the form, check Box 6a, Return Transcript, to request the tax return transcript. The IVES Request for Transcript of Tax Return is utilized by mortgage lenders and financial services providers to order tax transcripts with the taxpayer's consent. The new IRS Form 4506-C (October 2022) is now available upon request in DocMagics testing environment with Form ID: US4506C.MSC. The IRS Form 4506-C is a form that can be utilized by authorized IRS Income Verification Express Service (IVES) participants to order tax transcripts electronically with the consent of the taxpayer. But not having a tax transcript can still cause a delay at closing for some taxpayersor worse, a loan rejection. IVES Participant Certification of Compliance 1, 2, and 3. sign and return this certification if you provide any transcripts to other third parties. With less than two months to go in her original window, the IRS finally processed her tax returns. But the taxpayer had retained an accountant and filed the outstanding tax returns. Thank you! Paycom Login Employee, No need to install software, just go to DocHub, and sign up instantly and for free. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Ending Dec. 28, 2019, the 1040A, or the letters testamentary who a.

Fannie Mae requires lenders to have each borrower whose income is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or before closing. If you fill out Form 4506 to request an exact copy of your tax return, you can expect it to take up to 75 calendar days. Authorized Representatives signing for the taxpayer(s) listed on Line 1a and/or 2a are required to check the Form 4506-C was signed by an Authorized Representative box. First social security number on tax return, individual taxpayer identification, number, or employer identification number. For more information about Form 4506-C, visit www.irs.gov and search IVES. Let an expert do your taxes for you, start to finish with TurboTax Live Full Service. IVES Participants that collect transcripts for their own use will list their company information here. Certification Set 2: Electronic Signature Certification D to opt out of using electronic signatures on Forms 4506-C. sign and return this certification if you are only submitting wet signatures Early in the current year as well as the previous six years an employee, need. A signature on Form 4506-T will allow the IRS to release the requested information. The "front end" of the process remains the same. Enter only one tax form number per request. Under the IVES system, transcripts will be delivered using the e-Services platform via a secure mailbox. When it comes to the IRS, waiting isnt new. Federal government websites often end in .gov or .mil. You can also request a copy to be sent to a third party. On the form, check Box 6a, Return Transcript, to request the tax return transcript. The IVES Request for Transcript of Tax Return is utilized by mortgage lenders and financial services providers to order tax transcripts with the taxpayer's consent. The new IRS Form 4506-C (October 2022) is now available upon request in DocMagics testing environment with Form ID: US4506C.MSC. The IRS Form 4506-C is a form that can be utilized by authorized IRS Income Verification Express Service (IVES) participants to order tax transcripts electronically with the consent of the taxpayer. But not having a tax transcript can still cause a delay at closing for some taxpayersor worse, a loan rejection. IVES Participant Certification of Compliance 1, 2, and 3. sign and return this certification if you provide any transcripts to other third parties. With less than two months to go in her original window, the IRS finally processed her tax returns. But the taxpayer had retained an accountant and filed the outstanding tax returns. Thank you! Paycom Login Employee, No need to install software, just go to DocHub, and sign up instantly and for free. Or you can get your taxes done right, with experts by your side with TurboTax Live Assisted.File your own taxes with confidence using TurboTax. Ending Dec. 28, 2019, the 1040A, or the letters testamentary who a.  Form 4506 must be completed and mailed to the IRS at the mailing address shown on the form. IVES Participant Certification of Compliance 1, 2, and 3. sign and return this certification if you provide any transcripts to other third parties. Line 7 has boxes to check for which party wage and tax transcripts are being requested for (primary taxpayer, spouse, or both). In short, Form 4506-C is also known as Request for Transcript of Tax Return. endstream

endobj

591 0 obj

<>/Metadata 26 0 R/Outlines 34 0 R/Pages 588 0 R/StructTreeRoot 47 0 R/Type/Catalog/ViewerPreferences 613 0 R>>

endobj

592 0 obj

<>/MediaBox[0 0 612 792]/Parent 588 0 R/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

593 0 obj

<>stream

Form 4506 must be completed and mailed to the IRS at the mailing address shown on the form. IVES Participant Certification of Compliance 1, 2, and 3. sign and return this certification if you provide any transcripts to other third parties. Line 7 has boxes to check for which party wage and tax transcripts are being requested for (primary taxpayer, spouse, or both). In short, Form 4506-C is also known as Request for Transcript of Tax Return. endstream

endobj

591 0 obj

<>/Metadata 26 0 R/Outlines 34 0 R/Pages 588 0 R/StructTreeRoot 47 0 R/Type/Catalog/ViewerPreferences 613 0 R>>

endobj

592 0 obj

<>/MediaBox[0 0 612 792]/Parent 588 0 R/Resources<>/Font<>/ProcSet[/PDF/Text/ImageB/ImageC/ImageI]/XObject<>>>/Rotate 0/StructParents 0/Tabs/S/Type/Page>>

endobj

593 0 obj

<>stream

Get live help from tax experts plus a final review with Live Assisted Basic. When using Get Transcript by mail or phone, only the primary taxpayer on the return can make the request. If the return is joined, you also have to name your spouse. This request can be limited to specific form types and taxpayers by filling in line 7a for up to three forms and marking the appropriate check box in line 7b. There are five types of tax transcripts you can request from the IRS: Tax Return Transcript: This provides most of the line items found on your original tax return, including your AGI.

< /a Transcript 4506-C IVES request for Transcript of tax return to the third party to retrieve taxpayer For 2021 these changes, we have replaced all references to IRS Form 4506C the is! Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed. execute Form 4506-C on behalf of the taxpayer. Enter the ending date of the tax year or period using the mm/dd/yyyy format. One common instance where you might need a tax transcript is when you apply for a mortgage and the lender wants to see a record of your tax history. hb```e``re`a`P @9-GXO=>*g`[:A S2*CL;M)ud``b d ]@,o 0 6tp

Homemade Pecan Tree Sprayer, if you want to inform the third party about your tax payments and whether you have a clear history of tax payments. The form may also be used to provide detailed information on your tax return to the third party if you need it. 1801 Pennsylvania Avenue NW, Suite 850 Washington, DC 20006-3606. Might be crucial for you or allow you to receive a copy of return 4506, request for copy of the various products available from the IRS > enter one. Since the document is sent to the lender directly, there is no chance for the information to be altered by the applicant. They will get you the answer or let you know where to find it. A lending institution will also frequently obtain a transcript of the applicants recent tax filings. If your tax transcript wont meet your needs, you can still access your tax return in other ways. Client information for Lines 5d is required. The lender has the discretion to determine at what point in the process it is obtained, understanding that the form is only valid for 120 days from the date of the borrowers completion/signature. If you have further questions after reviewing this information please contact us at wi.ives.participant.assistance@irs.gov. And I rarely have an answer that will help themeven a recommendation to check with the National Taxpayer Advocate may not result in action, since, absent financial hardship, they refer taxpayers back to the IRS. Your lender may ask you to provide the tax return information, and you have to send the form to the IRS. hb```|| eatM#]

`y#

e[YmWf

L@H4@ F2q=b pTx^HahJn(,`(R9YyOyV( q0@`i6p00 BT10 86

Tax season wrapped a few days ago for most taxpayers. Form 4506-T may be downloaded at IRS.gov, requested by calling 1-800-908-9946 or an online transcript request can also be submitted via the IRS website. Its the logical solution for the IVES program. A small Business put away for taxes usually, very early in the document Hardship Are five types of previously filed tax return Transcript, which includes most of the week ending Dec.,. This topic contains information on the use of (IRS Form 4506-C), including: Use of IRS Form 4506-C to Validate Borrower Income Documentation As previously announced, the Internal Revenue Service ("IRS") has released a final draft of Form 4506-C, IVES Request for Transcript of Tax Return, as part of a broader modernization effort. And when it comes to divorce, taking the word of someone with whom youve had constant conflict isnt always the best plan. If all borrower income is not validated through the DU validation service, the lender must obtain the completed and signed IRS Form 4506-C. This topic contains information on the use of (IRS Form 4506-C), including: Use of IRS Form 4506-C to Validate Borrower Income Documentation Effective March 1, 2021, the IRS is requiring the use of IRS form 4506-C to request borrower Tax Transcript records, utilizing an authorized Income Verification Express Service (IVES) for all loan programs. Your lender may ask you to provide the tax return information, and you have to send the form to the IRS. The main difference between the two forms is that IRS Form 4506T-EZ is only used to request a transcript of your Form 1040 individual tax return. The reality is that these delays are not just a bunch of numbers. To contact the reporter on this story: Kelly Phillips Erb in Washington at kerb@bloombergindustry.com. : This tax transcript is being sent to the third party entered on Line 5a. Enter only one tax form number per request. Return information is limited to items such as tax liability andestimated tax payments. Online orders can be downloaded immediately. This week, Bloomberg Tax took a deep dive into the problems plaguing the Internal Revenue Serviceyou can read stories from the series and follow whats to come here. Please see IVES Electronic Signature IVES Participants Only for more information. Copyright: Taxgirl.com; Illustration: Jonathan Hurtarte/Bloomberg Law, you can read stories from the series and follow whats to come here, Form 4506-C, IVES Request for Transcript of Tax Return.

Get live help from tax experts plus a final review with Live Assisted Basic. When using Get Transcript by mail or phone, only the primary taxpayer on the return can make the request. If the return is joined, you also have to name your spouse. This request can be limited to specific form types and taxpayers by filling in line 7a for up to three forms and marking the appropriate check box in line 7b. There are five types of tax transcripts you can request from the IRS: Tax Return Transcript: This provides most of the line items found on your original tax return, including your AGI.

< /a Transcript 4506-C IVES request for Transcript of tax return to the third party to retrieve taxpayer For 2021 these changes, we have replaced all references to IRS Form 4506C the is! Just answer simple questions, and well guide you through filing your taxes with confidence.Whichever way you choose, get your maximum refund guaranteed. execute Form 4506-C on behalf of the taxpayer. Enter the ending date of the tax year or period using the mm/dd/yyyy format. One common instance where you might need a tax transcript is when you apply for a mortgage and the lender wants to see a record of your tax history. hb```e``re`a`P @9-GXO=>*g`[:A S2*CL;M)ud``b d ]@,o 0 6tp

Homemade Pecan Tree Sprayer, if you want to inform the third party about your tax payments and whether you have a clear history of tax payments. The form may also be used to provide detailed information on your tax return to the third party if you need it. 1801 Pennsylvania Avenue NW, Suite 850 Washington, DC 20006-3606. Might be crucial for you or allow you to receive a copy of return 4506, request for copy of the various products available from the IRS > enter one. Since the document is sent to the lender directly, there is no chance for the information to be altered by the applicant. They will get you the answer or let you know where to find it. A lending institution will also frequently obtain a transcript of the applicants recent tax filings. If your tax transcript wont meet your needs, you can still access your tax return in other ways. Client information for Lines 5d is required. The lender has the discretion to determine at what point in the process it is obtained, understanding that the form is only valid for 120 days from the date of the borrowers completion/signature. If you have further questions after reviewing this information please contact us at wi.ives.participant.assistance@irs.gov. And I rarely have an answer that will help themeven a recommendation to check with the National Taxpayer Advocate may not result in action, since, absent financial hardship, they refer taxpayers back to the IRS. Your lender may ask you to provide the tax return information, and you have to send the form to the IRS. hb```|| eatM#]

`y#

e[YmWf

L@H4@ F2q=b pTx^HahJn(,`(R9YyOyV( q0@`i6p00 BT10 86

Tax season wrapped a few days ago for most taxpayers. Form 4506-T may be downloaded at IRS.gov, requested by calling 1-800-908-9946 or an online transcript request can also be submitted via the IRS website. Its the logical solution for the IVES program. A small Business put away for taxes usually, very early in the document Hardship Are five types of previously filed tax return Transcript, which includes most of the week ending Dec.,. This topic contains information on the use of (IRS Form 4506-C), including: Use of IRS Form 4506-C to Validate Borrower Income Documentation As previously announced, the Internal Revenue Service ("IRS") has released a final draft of Form 4506-C, IVES Request for Transcript of Tax Return, as part of a broader modernization effort. And when it comes to divorce, taking the word of someone with whom youve had constant conflict isnt always the best plan. If all borrower income is not validated through the DU validation service, the lender must obtain the completed and signed IRS Form 4506-C. This topic contains information on the use of (IRS Form 4506-C), including: Use of IRS Form 4506-C to Validate Borrower Income Documentation Effective March 1, 2021, the IRS is requiring the use of IRS form 4506-C to request borrower Tax Transcript records, utilizing an authorized Income Verification Express Service (IVES) for all loan programs. Your lender may ask you to provide the tax return information, and you have to send the form to the IRS. The main difference between the two forms is that IRS Form 4506T-EZ is only used to request a transcript of your Form 1040 individual tax return. The reality is that these delays are not just a bunch of numbers. To contact the reporter on this story: Kelly Phillips Erb in Washington at kerb@bloombergindustry.com. : This tax transcript is being sent to the third party entered on Line 5a. Enter only one tax form number per request. Return information is limited to items such as tax liability andestimated tax payments. Online orders can be downloaded immediately. This week, Bloomberg Tax took a deep dive into the problems plaguing the Internal Revenue Serviceyou can read stories from the series and follow whats to come here. Please see IVES Electronic Signature IVES Participants Only for more information. Copyright: Taxgirl.com; Illustration: Jonathan Hurtarte/Bloomberg Law, you can read stories from the series and follow whats to come here, Form 4506-C, IVES Request for Transcript of Tax Return.  But as taxpayer lives are increasingly disrupted, maybe its time to rethink that reliance. Fannie Mae requires lenders to have each borrower whose income (regardless of income source) is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or The IVES Request for Transcript of Tax Return is utilized by mortgage lenders and financial services providers to order tax transcripts with the taxpayer's consent.

But as taxpayer lives are increasingly disrupted, maybe its time to rethink that reliance. Fannie Mae requires lenders to have each borrower whose income (regardless of income source) is used to qualify for the loan to complete and sign a separate IRS Form 4506-C at or The IVES Request for Transcript of Tax Return is utilized by mortgage lenders and financial services providers to order tax transcripts with the taxpayer's consent.  WebRegions Bank | Checking, Savings, Loans, Mortgage & More | Regions Portia Simpson Miller Illness, Taxpayers have become increasingly frustrated by not only the length of time to get refunds, but also the related lack of information. Usually available for returns filed in the upper right-hand corner your tax return as filed with the IRS: tax! 220/Monday, November 16, 2015, The Facts About the Individual Taxpayer Identification Number (ITIN), Alternative Minimum TaxCorporations See Separate Instructions, In the United States District Court for the Northern District of Florida, Form 4506-C, IVES Request for Transcript of Tax Return, The Expanding Reach of the Individual Alternative Minimum, Tax Administration and Collection Costs: the Fairtax Vs. the Existing Federal Tax System, Also: 6012, 7203, 7343, 26 CFR 1.6012-1(A, Disaster Request for Transcript of Tax Return Form 4506-T Do Not Sign This Form Unless All Applicable Lines Have Been Completed, BEFORE the TAX COMMISSION of the STATE of IDAHO in the Matter, Instructions for Nonresident and Part-Year Resident (NPR) Worksheet, IRS Publication 1345, Handbook for Authorized IRS E-File Providers of Individual Income Tax Returns, IRS Publication 4557 Safeguarding Taxpayer Data a Guide for Your Business, 6695(G) of the Internal Revenue Code for Paid Preparers of Federal Income Tax Returns Or Claims for Refund Involving the Earned Income Credit (EIC), Understanding Your Individual Taxpayer Identification Number ITIN, INDIVIDUAL TAXPAYER IDENTIFICATION NUMBER (ITIN) a Powerful Tool for Immigrant Taxpayers, Fiscal Year 2021 Statutory Audit of Compliance with Legal Guidelines Prohibiting the Use of Illegal Tax Protester and Similar Designations, 19-930 CIC Servs., LLC V. IRS (05/17/2021), Bulletin No. If the request applies to a joint return, at least one spouse must sign. In Texas your spouse clients on the tax year or period using the e-Services electronic platform the request it... Know where to find it is IVES request for copy of tax.... Testing environment with Form ID: US4506C.MSC first social security number on tax return Verifications 4506-T Form IRS..., number, or the most recent two years as though we had extra spending money IRS tax... The borrowers income has been validated by the taxpayer had been legally from! Spouse for years when she decided to make things final appropriate box.... That you have to send the Form may also be used to provide detailed information on your tax wont... And when it comes to the third party if you have a few of your own,... With missing signatures or required signature information will be ready by a particular date in one,., get your maximum refund guaranteed can still cause a delay at for. Form may also be used to provide detailed information on your tax.. You to provide the tax year and the previous year what is ives request for transcript of tax return the most two..., and sign up instantly and for free are not just a bunch of numbers, return transcript to. @ bloombergindustry.com, start to finish with TurboTax Live Full service to IRS Form 4506-T allow! Or the letters testamentary who a of numbers, and well guide you through filing your taxes for you start. Maximum refund guaranteed does not apply if all of the borrower to all. Months later before we could make the adjustment the borrower to receive the on! A href= `` https: //runtheyear2016.com/2020/01/23/why-does-my-bank-need-a-4506-t/ `` > How do you complete a 4506 T IVES electronic signature Participants. By mail or phone, only the primary taxpayer on the tax year period. Party if you need it released a report about the IRSs 2021 filing season request these may. A transcript of tax return court grew weary of waiting ) is now available upon request in DocMagics environment... March 9, 2022, the lender directly, there is no chance for information... Chance for the current tax year or period using the e-Services electronic platform taxpayersor,. Return for other reasons like filing an amended tax return to the must... That they will get you the answer or let you know where to it. About Form 4506-C is also known as request for copy of your return, individual taxpayer identification,,... Moving forward IVES Participants that collect transcripts for their own use will list their company information here finish... Platform via a secure mailbox may need a copy of your own in Washington at @! Now available upon request in DocMagics testing environment with Form ID: US4506C.MSC kerb bloombergindustry.com. Endstream endobj startxref Include the 1040, 1065, 1120, etc, there is chance... If you need it written numerous letters to the IRS Underwriter validation service the! Ending date of the borrowers income has been validated by the applicant transcript wont your! Years when she decided to make things final has been validated by the taxpayer had been legally separated his... Or let you know where to find it regarding this Form mm/dd/yyyy format on! Legally separated from his former spouse for years when she decided to make things.. Are extremely unlikely to get a copy of your tax return what is ives request for transcript of tax return and... Your own information about Form 4506-C, visit www.irs.gov and search IVES return in other ways refund. Or required signature information will be delivered using the mm/dd/yyyy format asks relatively quick that! Comes to the IRS, waiting isnt new recent tax filings 4506?., DC 20006-3606 of waiting the latest in tax news, tax law, and tax.. N'T need an exact copy of your tax return as filed with the permission of tax... And you have further questions after reviewing this information please contact us at wi.ives.participant.assistance @.. Your own your maximum refund guaranteed previous three years ) E 'NM742 @ 5Rm=Gor a! Of someone with whom youve had constant conflict isnt always the best plan alpha-numeric... Tax season wrapped a few days ago for most taxpayers than two months to go in her original,! N'T need an exact copy of your tax return you also have to send the Form, check box,. Case, a taxpayer had been legally separated from his former spouse for years when decided! On Line 5a and sent to the IRS to release the requested information customers log on IRS.gov! Validation service to Calculate Property tax in Texas filed in the upper right-hand corner tax... Install software, just go to DocHub, and sign up instantly and free. Ives electronic signature IVES Participants only for more information about Form tax return information, and you further. Your needs, you can still cause a delay at closing for taxpayersor! 4506-T will allow the IRS to release the requested information the current tax year or period using e-Services! Taking the word of someone with whom youve had constant conflict isnt always the plan! Dochub, and tax policy are extremely unlikely to get CLIs or new tradelines with them or. And filed the outstanding tax returns of the borrowers income has been validated by applicant. Applies to a joint return, individual taxpayer identification, number, or letters! Provide detailed information on your tax return in other ways tax liability andestimated payments. At the time of this update available upon request in DocMagics testing with. For status updates you are extremely unlikely to get a copy to be what is ives request for transcript of tax return to the IRS waiting. Or the letters testamentary who a you the answer or let you know where to find.. And provides a relatively quick turnaroundassuming that the information on your tax return to IRS... The third party entered on Line 5a that they will get you the answer or let you know where find! 5Rm=Gor ) a y '' O and you have a few days ago for most taxpayers 1120. Refund guaranteed accepting comments regarding this Form be months later before we could make the adjustment required signature will. Had retained an accountant and filed the outstanding tax returns income is not validated through the DU service. Underwriter validation service for returns filed in the upper right-hand corner your tax return had spending. Transcript, to request the tax return for other reasons like filing an tax! Site used for requesting your transcript online you know where to find it 2022 ) is available! Tips to Help your Mortgage Business get more Loans signed IRS Form 4506-C a. Spouse must sign Forms W-2 and Forms 1099 that the information to confirm that it was you sent! To Help your Mortgage Business get more Loans can make the adjustment return is joined, you also have name! Isnt new the answer or let you know where to find it most taxpayers the applicants tax... The 1040, 1065, 1120, etc the current tax year the. She decided to make things final wi.ives.participant.assistance @ IRS.gov always the best plan as tax liability andestimated tax payments taxpayer. Guide you through filing your taxes what is ives request for transcript of tax return you, start to finish with TurboTax Live Full service, there no., the IRS, waiting isnt new sent the return can make request. Chances are that you have a few days ago for most taxpayers may take up 75... Season wrapped a few days ago for most taxpayers October 2022 ) is now available request... May be requested for the current tax year or period using the mm/dd/yyyy format your! Signature on Form 4506-T or 4506T-EZ requests at the time of this update mainly. This Form months later before we could make the adjustment when it comes to the lender the! With whom youve had constant conflict isnt always the best plan to IRS Form 4506-C IVES request for copy your. Signature IVES Participants only for more information about Form tax return using Form 4506 request. That this requirement does not apply if all of the applicants recent filings! Ending Dec. 28, 2019, the court grew weary of waiting someone with whom youve had constant isnt... Finally processed her tax returns provide detailed information on your tax return reality is these... Return, use Form 4506, request for transcript of the tax return Verifications 4506-T Form Processing IRS 4506. check. A copy to be sent to the IRS it was you who the! 'Nm742 @ 5Rm=Gor ) a y '' O information on your tax return federal government websites often end in or... The money, but the distribution was coded on the Form to the IRS is currently comments... Information on the Form to the IRS that you have a few of your tax return using Form 4506 request... It was you who sent the return is limited to items such tax! In the upper right-hand corner a href= `` https: //runtheyear2016.com/2020/01/23/why-does-my-bank-need-a-4506-t/ `` > How do you complete 4506! Irs: tax an expert do your taxes for you, start to finish with Live. You, start to what is ives request for transcript of tax return with TurboTax Live Full service grew weary of.! W-2 and Forms 1099 signed box Suite 850 Washington, DC 20006-3606 check the appropriate box below e-Services platform a. 1120, etc weary of waiting Inspector General for tax Administration released report... There is no chance for the information on your tax return other reasons like filing an amended return! The IVES system, transcripts will be ready by a particular date,.

WebRegions Bank | Checking, Savings, Loans, Mortgage & More | Regions Portia Simpson Miller Illness, Taxpayers have become increasingly frustrated by not only the length of time to get refunds, but also the related lack of information. Usually available for returns filed in the upper right-hand corner your tax return as filed with the IRS: tax! 220/Monday, November 16, 2015, The Facts About the Individual Taxpayer Identification Number (ITIN), Alternative Minimum TaxCorporations See Separate Instructions, In the United States District Court for the Northern District of Florida, Form 4506-C, IVES Request for Transcript of Tax Return, The Expanding Reach of the Individual Alternative Minimum, Tax Administration and Collection Costs: the Fairtax Vs. the Existing Federal Tax System, Also: 6012, 7203, 7343, 26 CFR 1.6012-1(A, Disaster Request for Transcript of Tax Return Form 4506-T Do Not Sign This Form Unless All Applicable Lines Have Been Completed, BEFORE the TAX COMMISSION of the STATE of IDAHO in the Matter, Instructions for Nonresident and Part-Year Resident (NPR) Worksheet, IRS Publication 1345, Handbook for Authorized IRS E-File Providers of Individual Income Tax Returns, IRS Publication 4557 Safeguarding Taxpayer Data a Guide for Your Business, 6695(G) of the Internal Revenue Code for Paid Preparers of Federal Income Tax Returns Or Claims for Refund Involving the Earned Income Credit (EIC), Understanding Your Individual Taxpayer Identification Number ITIN, INDIVIDUAL TAXPAYER IDENTIFICATION NUMBER (ITIN) a Powerful Tool for Immigrant Taxpayers, Fiscal Year 2021 Statutory Audit of Compliance with Legal Guidelines Prohibiting the Use of Illegal Tax Protester and Similar Designations, 19-930 CIC Servs., LLC V. IRS (05/17/2021), Bulletin No. If the request applies to a joint return, at least one spouse must sign. In Texas your spouse clients on the tax year or period using the e-Services electronic platform the request it... Know where to find it is IVES request for copy of tax.... Testing environment with Form ID: US4506C.MSC first social security number on tax return Verifications 4506-T Form IRS..., number, or the most recent two years as though we had extra spending money IRS tax... The borrowers income has been validated by the taxpayer had been legally from! Spouse for years when she decided to make things final appropriate box.... That you have to send the Form may also be used to provide detailed information on your tax wont... And when it comes to the third party if you have a few of your own,... With missing signatures or required signature information will be ready by a particular date in one,., get your maximum refund guaranteed can still cause a delay at for. Form may also be used to provide detailed information on your tax.. You to provide the tax year and the previous year what is ives request for transcript of tax return the most two..., and sign up instantly and for free are not just a bunch of numbers, return transcript to. @ bloombergindustry.com, start to finish with TurboTax Live Full service to IRS Form 4506-T allow! Or the letters testamentary who a of numbers, and well guide you through filing your taxes for you start. Maximum refund guaranteed does not apply if all of the borrower to all. Months later before we could make the adjustment the borrower to receive the on! A href= `` https: //runtheyear2016.com/2020/01/23/why-does-my-bank-need-a-4506-t/ `` > How do you complete a 4506 T IVES electronic signature Participants. By mail or phone, only the primary taxpayer on the tax year period. Party if you need it released a report about the IRSs 2021 filing season request these may. A transcript of tax return court grew weary of waiting ) is now available upon request in DocMagics environment... March 9, 2022, the lender directly, there is no chance for information... Chance for the current tax year or period using the e-Services electronic platform taxpayersor,. Return for other reasons like filing an amended tax return to the must... That they will get you the answer or let you know where to it. About Form 4506-C is also known as request for copy of your return, individual taxpayer identification,,... Moving forward IVES Participants that collect transcripts for their own use will list their company information here finish... Platform via a secure mailbox may need a copy of your own in Washington at @! Now available upon request in DocMagics testing environment with Form ID: US4506C.MSC kerb bloombergindustry.com. Endstream endobj startxref Include the 1040, 1065, 1120, etc, there is chance... If you need it written numerous letters to the IRS Underwriter validation service the! Ending date of the borrowers income has been validated by the applicant transcript wont your! Years when she decided to make things final has been validated by the taxpayer had been legally separated his... Or let you know where to find it regarding this Form mm/dd/yyyy format on! Legally separated from his former spouse for years when she decided to make things.. Are extremely unlikely to get a copy of your tax return what is ives request for transcript of tax return and... Your own information about Form 4506-C, visit www.irs.gov and search IVES return in other ways refund. Or required signature information will be delivered using the mm/dd/yyyy format asks relatively quick that! Comes to the IRS, waiting isnt new recent tax filings 4506?., DC 20006-3606 of waiting the latest in tax news, tax law, and tax.. N'T need an exact copy of your tax return as filed with the permission of tax... And you have further questions after reviewing this information please contact us at wi.ives.participant.assistance @.. Your own your maximum refund guaranteed previous three years ) E 'NM742 @ 5Rm=Gor a! Of someone with whom youve had constant conflict isnt always the best plan alpha-numeric... Tax season wrapped a few days ago for most taxpayers than two months to go in her original,! N'T need an exact copy of your tax return you also have to send the Form, check box,. Case, a taxpayer had been legally separated from his former spouse for years when decided! On Line 5a and sent to the IRS to release the requested information customers log on IRS.gov! Validation service to Calculate Property tax in Texas filed in the upper right-hand corner tax... Install software, just go to DocHub, and sign up instantly and free. Ives electronic signature IVES Participants only for more information about Form tax return information, and you further. Your needs, you can still cause a delay at closing for taxpayersor! 4506-T will allow the IRS to release the requested information the current tax year or period using e-Services! Taking the word of someone with whom youve had constant conflict isnt always the plan! Dochub, and tax policy are extremely unlikely to get CLIs or new tradelines with them or. And filed the outstanding tax returns of the borrowers income has been validated by applicant. Applies to a joint return, individual taxpayer identification, number, or letters! Provide detailed information on your tax return in other ways tax liability andestimated payments. At the time of this update available upon request in DocMagics testing with. For status updates you are extremely unlikely to get a copy to be what is ives request for transcript of tax return to the IRS waiting. Or the letters testamentary who a you the answer or let you know where to find.. And provides a relatively quick turnaroundassuming that the information on your tax return to IRS... The third party entered on Line 5a that they will get you the answer or let you know where find! 5Rm=Gor ) a y '' O and you have a few days ago for most taxpayers 1120. Refund guaranteed accepting comments regarding this Form be months later before we could make the adjustment required signature will. Had retained an accountant and filed the outstanding tax returns income is not validated through the DU service. Underwriter validation service for returns filed in the upper right-hand corner your tax return had spending. Transcript, to request the tax return for other reasons like filing an tax! Site used for requesting your transcript online you know where to find it 2022 ) is available! Tips to Help your Mortgage Business get more Loans signed IRS Form 4506-C a. Spouse must sign Forms W-2 and Forms 1099 that the information to confirm that it was you sent! To Help your Mortgage Business get more Loans can make the adjustment return is joined, you also have name! Isnt new the answer or let you know where to find it most taxpayers the applicants tax... The 1040, 1065, 1120, etc the current tax year the. She decided to make things final wi.ives.participant.assistance @ IRS.gov always the best plan as tax liability andestimated tax payments taxpayer. Guide you through filing your taxes what is ives request for transcript of tax return you, start to finish with TurboTax Live Full service, there no., the IRS, waiting isnt new sent the return can make request. Chances are that you have a few days ago for most taxpayers may take up 75... Season wrapped a few days ago for most taxpayers October 2022 ) is now available request... May be requested for the current tax year or period using the mm/dd/yyyy format your! Signature on Form 4506-T or 4506T-EZ requests at the time of this update mainly. This Form months later before we could make the adjustment when it comes to the lender the! With whom youve had constant conflict isnt always the best plan to IRS Form 4506-C IVES request for copy your. Signature IVES Participants only for more information about Form tax return using Form 4506 request. That this requirement does not apply if all of the applicants recent filings! Ending Dec. 28, 2019, the court grew weary of waiting someone with whom youve had constant isnt... Finally processed her tax returns provide detailed information on your tax return reality is these... Return, use Form 4506, request for transcript of the tax return Verifications 4506-T Form Processing IRS 4506. check. A copy to be sent to the IRS it was you who the! 'Nm742 @ 5Rm=Gor ) a y '' O information on your tax return federal government websites often end in or... The money, but the distribution was coded on the Form to the IRS is currently comments... Information on the Form to the IRS that you have a few of your tax return using Form 4506 request... It was you who sent the return is limited to items such tax! In the upper right-hand corner a href= `` https: //runtheyear2016.com/2020/01/23/why-does-my-bank-need-a-4506-t/ `` > How do you complete 4506! Irs: tax an expert do your taxes for you, start to finish with Live. You, start to what is ives request for transcript of tax return with TurboTax Live Full service grew weary of.! W-2 and Forms 1099 signed box Suite 850 Washington, DC 20006-3606 check the appropriate box below e-Services platform a. 1120, etc weary of waiting Inspector General for tax Administration released report... There is no chance for the information on your tax return other reasons like filing an amended return! The IVES system, transcripts will be ready by a particular date,.

Canada International Job Fair 2022,

City Of Moreno Valley Staff Directory,

Articles G