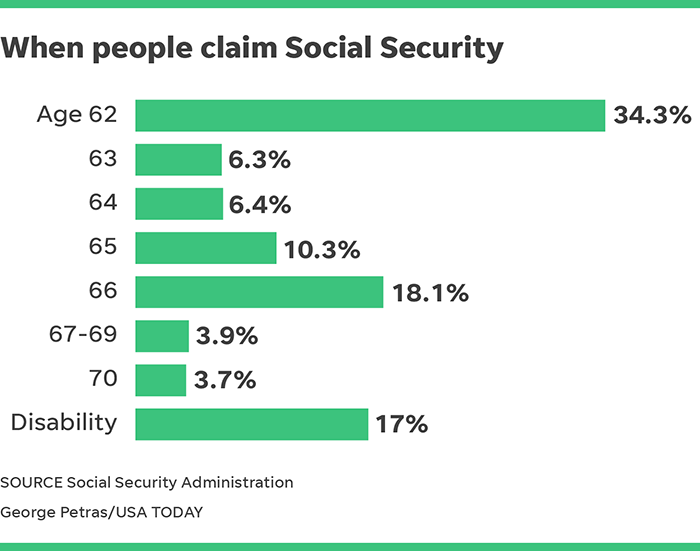

Careful planning for potentially devastating long-term care costs can help protect your estate, whether for your spouse or for your children. You must earn $5,880 to get the maximum four credits for the year. For example, if you worked as an engineer for 20 years before you began teaching, you may be able to do enough part time work between now and when you retire to completely eliminate the monthly WEP reduction. If you have a pension from a job where you did not pay Social Security taxes, your benefit may be reduced by the Windfall Elimination Provision (WEP). Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP The Magazine. Im 66, I did 19 CSRS and 18 FRS I got hit with WEP does working a small PT job to eliminate one zero and one temporary job back in the 70s help a little. If I apply for a spousal pension now, I will receive $919 per month. Medicare Savings Programs are federally funded assistance programs that each state administers to help with the costs associated with Medicare. I retired in 1998 and was horrified that my social security was much lower than my pension as I had paid to both and after reading this I understand. Will your penalty amount increase? Understanding your Social Security Date Last Insured for Disability, Non-Medical Reasons You Might Be Denied SSDI Benefits. People who do not have 40 quarters of qualifying employment may buy Medicare Part A. There are a few circumstances where the application of the Windfall Elimination Provision will end. You would need your earnings to meet or exceed the wage base limit every year for 35 years. Since 2010, Citizens Disability has been Americas premier Social Security Disability institution. In 2021, you earn one credit for each $1,470 in income from covered work. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. Can you buy up 40 quarters. I am currently receiving a small pension from Calstrs. When my ex husband dies, I will then collect under his earnings, assuming that I am still alive. How can I find how many quarters I have in Social Security? For 2023, you will receive one-quarter of coverage for every $1,640 earned, with a maximum of four credits available per calendar year. To be eligible for Medicaid long-term care, recipients must have limited incomes and no more than $2,000 (in most states). It is useful for people of all ages who want to learn about their future Social Security benefits and current earnings history. These include raising your income as high as you can, making sure to work at least 35 years, or delaying claiming Social Security as long as possible (until age 70) so you can earn delayed retirement credits that boost the size of your checks. (QC)also called a "credit"for a certain amount of work covered Disability Benefits. While we have many attorneys on our staff, we are not a law firm and do not provide legal service or represent claimants in an attorney-client relationship in this process. Learn more about the costs for 2020, including coinsurance and deductibles. Heres How To Find Answers, https://www.facebook.com/groups/428684237572614/. WebGenerally speaking, to be insured for SSDI benefits you must have earned at least 20 work credits during the past 40 quarters (10 years) prior to the onset of your disability. Why SJF Cannot be implemented practically? How Viagra became a new 'tool' for young men, Ankylosing Spondylitis Pain: Fact or Fiction, Debra Sullivan, Ph.D., MSN, R.N., CNE, COI, withheld taxes for Medicare and Social Security, Eligibility based on a spouses work history, https://www.medicare.gov/Pubs/pdf/10126-Getting-Help-With-Your-Medicare-Costs.pdf, https://www.medicare.gov/your-medicare-costs/part-a-costs, https://www.medicare.gov/your-medicare-costs/get-help-paying-costs/medicare-savings-programs, https://www.medicare.gov/your-medicare-costs/part-b-costs, https://www.ssa.gov/ssi/text-entitle-ussi.htm. Updates. 25,983 satisfied customers. If I loose 50% of my SS benefit because of WEP, my total retirement income will be less than $2000 per month, after SSA deducts payment for Medicare Part B. Do they have the right to cut my benefits before I receive my pension? This cookie is set by GDPR Cookie Consent plugin. If you start taking SS BEFORE you reach full retirement age, then the amount you can earn is limited. For instance, a person does not get additional Medicare Part A benefits or discounts because they earned more than the minimum 40 quarters. Paragraph five should be updated to state that some federal employees are subject to the Windfall Elimination Provision, too. Our mission is to give a voice to the millions of Americans who are disabled and unable to work, helping them receive the Social Security Disability benefits to which they may be entitled. I am getting pension from Indian government for that job since 1993. The cookie is used to store the user consent for the cookies in the category "Analytics". Before I retired I got half of my exhusbands Soc Security. Learn how a special needs trust can preserve assets for a person with disabilities without jeopardizing Medicaid and SSI, and how to plan for when caregivers are gone. Beyond age 31, the test is five years (20 credits) of work in the decade immediately before you became disabled. If my husband dies before i do, can i receive his social security (significantly higher than my ss) instead of mine with a wep offset and still collect my strs pension? The amount of earnings required to earn one work credit is set by the Social Security Administration and subject to change on a yearly basis. We need to plan for the possibility that we will become unable to make our own medical decisions. It starts by understanding the mechanics of the Windfall Elimination Provision.  How many social security credits can you get per year? But the good news is that there are other ways to maximize your personal benefits, even if you can't earn the largest possible amount. If you start taking SS BEFORE you reach full retirement age, then the amount you can earn is limited. Do both the WEP and the GPO come into play when spousal benefits would be higher than the individuals own social security benefit? That's why people who make millions of dollars a year still get the same max benefit as someone who makes closer to $150,000. Is it necessary to work for ten years to earn 40 credits? Regardless of a persons income amount, they cannot earn more than four credits in 1 year. I just foundRead more . Your benefit amount is reduced due to your age, but does the WEP penalty decrease as well? However, his spousal benefit under his wifes social security would be considerably higher than his own social security benefit. My wife that left me few months ago just came back to me last night crying for me to take her back. I believe the original target was well-paid members of Congress and that there is a bill to repeal all or part of WEP that is still in committee. 2) If so, when calculating the WEP penalty does it include every type of pension? Generally you need to be fully insured to receive Social Security benefits, From time to time Ill even drop in to add my thoughts, too. That would mean starting out at a high salary and staying there for decades. A To be insured for Social Security Retirement Insurance (RIB) benefits, a worker must be fully insured. He or she becomes fully insured by having 40 earned quarters typically four per year for 10 years of work. If I move my member directed Ohio plan into a qualified retirement plan can I avoid the windfall? I dont recall exactly what it is. Its quite common too. All I ever wanted is what I have earned nothing more or less. To figure out your average monthly wage, the SSA adds up the inflation-adjusted wages you earned over the 35 years you earned the most money and divides

How many social security credits can you get per year? But the good news is that there are other ways to maximize your personal benefits, even if you can't earn the largest possible amount. If you start taking SS BEFORE you reach full retirement age, then the amount you can earn is limited. Do both the WEP and the GPO come into play when spousal benefits would be higher than the individuals own social security benefit? That's why people who make millions of dollars a year still get the same max benefit as someone who makes closer to $150,000. Is it necessary to work for ten years to earn 40 credits? Regardless of a persons income amount, they cannot earn more than four credits in 1 year. I just foundRead more . Your benefit amount is reduced due to your age, but does the WEP penalty decrease as well? However, his spousal benefit under his wifes social security would be considerably higher than his own social security benefit. My wife that left me few months ago just came back to me last night crying for me to take her back. I believe the original target was well-paid members of Congress and that there is a bill to repeal all or part of WEP that is still in committee. 2) If so, when calculating the WEP penalty does it include every type of pension? Generally you need to be fully insured to receive Social Security benefits, From time to time Ill even drop in to add my thoughts, too. That would mean starting out at a high salary and staying there for decades. A To be insured for Social Security Retirement Insurance (RIB) benefits, a worker must be fully insured. He or she becomes fully insured by having 40 earned quarters typically four per year for 10 years of work. If I move my member directed Ohio plan into a qualified retirement plan can I avoid the windfall? I dont recall exactly what it is. Its quite common too. All I ever wanted is what I have earned nothing more or less. To figure out your average monthly wage, the SSA adds up the inflation-adjusted wages you earned over the 35 years you earned the most money and divides  Once you have 40 credits, you pass the duration test no matter your age. You should consult an advocate for advice regarding your individual situation. Analytical cookies are used to understand how visitors interact with the website. This was because the WEP penalty was removed when Dave died. That depends on your age when you become disabled. AARP Membership $12 for your first year when you sign up for Automatic Renewal. There are four different Medicare Savings programs. The 40-quarters rule only applies to premium-free Medicare Part A. The Prediction: 3 Stocks That Will Turn $200,000 Into $1 Million by 2033, A Bull Market Is Coming: 1 Supercharged Growth Stock to Buy Hand Over Fist Before It Soars 113%, According to Wall Street, 1 Monster Growth Stock With 697% Upside, According to Wall Street, 2 Nasdaq Stocks I'm Buying Till I'm Blue in the Face, Join Over Half a Million Premium Members And Get More In-Depth Stock Guidance and Research, Copyright, Trademark and Patent Information. Not a dime for me and my extended family until I have cancer, which unfortunately everyone of my platoon mates have. In addition to nursing home care, Medicaid may cover home care and some care in an assisted living facility. To be fully insured, you need at least one QC for each Work Credits are earned by paying FICA taxes. In 2021, you earn one Social Security or Medicare credit for every $1,470 in covered earnings each year. Medicare Part B covers medical expenses and outpatient care. https://www.ssa.gov/pubs/EN-05-10045.pdf. Would love your thoughts, please comment. She has been collecting Social Security for several years now. The Social Security Administration (SSA) keeps a record of earnings over your working life and pays benefits that are based on the average amount earned, provided a minimum number of work credits have been accumulated. For premium-free Medicare Part A, an individual must have worked 40 quarters. Medicare divides yearly earning into quarters to determine how many credits a person has earned. consider the number of quarters of coverage you You were born in 1949 and worked under covered employment in 1971-77, Medical News Today has strict sourcing guidelines and draws only from peer-reviewed studies, academic research institutions, and medical journals and associations. Between the ages of 24 and 31, you must have spent at least half the time since turning 21 in covered work. Get instant access to members-only products and hundreds of discounts, a FREE second membership, and a subscription toAARP The Magazine. Disability Insured To be eligible for Social Security retirement benefits, a worker born after 1928 must have accumulated at least 40 quarters of work in "covered employment". Just give people what they have earned. At 40, it's 4.5 years (18 credits); at 50, 7 years (28 credits); at Generally speaking, to be insured for SSDI benefits you must have earned at least 20 work credits during the past 40 quarters (10 years) prior to the onset of your disability. The WEP computation is no longer used when: The most notable point is when an individual who is subject to the WEP dies. In 2021, the wage base limit is $142,800. So I have a disabled family member who always worked full time minimum/low wage jobs well over 30 years in social security however he never met the substantial earnings threshold. The amount of earnings required for a quarter of coverage (QC) in 2023 is $1,640. "Quarter of coverage" is a legal term , but you may also see the term "Social Security credit" (or just "credit") used elsewhere. A QC is the basic unit for determining whether a worker is insured under the Social Security program. SS earnings. In order for the offset to apply, the non-covered pension must come from YOUR work. After that, it roughly follows a formula: You must have at least as many credits as the number of years since you turned 22. Tracy here From Austria I want to say a very big thanks and appreciation to DR. AKERECO of all spell casters worldwide for bringing back my husband who left me and the kids for almost six months within the space of two days after following all instructions given to me. Many teachers came to education as a second career, after theyd spent years working in a job where Social Security taxes were withheld. However, since I live outside the US for the past 18 years I receive a pension from my Israeli employers fund and am not clear how the SSA relates to this.

Once you have 40 credits, you pass the duration test no matter your age. You should consult an advocate for advice regarding your individual situation. Analytical cookies are used to understand how visitors interact with the website. This was because the WEP penalty was removed when Dave died. That depends on your age when you become disabled. AARP Membership $12 for your first year when you sign up for Automatic Renewal. There are four different Medicare Savings programs. The 40-quarters rule only applies to premium-free Medicare Part A. The Prediction: 3 Stocks That Will Turn $200,000 Into $1 Million by 2033, A Bull Market Is Coming: 1 Supercharged Growth Stock to Buy Hand Over Fist Before It Soars 113%, According to Wall Street, 1 Monster Growth Stock With 697% Upside, According to Wall Street, 2 Nasdaq Stocks I'm Buying Till I'm Blue in the Face, Join Over Half a Million Premium Members And Get More In-Depth Stock Guidance and Research, Copyright, Trademark and Patent Information. Not a dime for me and my extended family until I have cancer, which unfortunately everyone of my platoon mates have. In addition to nursing home care, Medicaid may cover home care and some care in an assisted living facility. To be fully insured, you need at least one QC for each Work Credits are earned by paying FICA taxes. In 2021, you earn one Social Security or Medicare credit for every $1,470 in covered earnings each year. Medicare Part B covers medical expenses and outpatient care. https://www.ssa.gov/pubs/EN-05-10045.pdf. Would love your thoughts, please comment. She has been collecting Social Security for several years now. The Social Security Administration (SSA) keeps a record of earnings over your working life and pays benefits that are based on the average amount earned, provided a minimum number of work credits have been accumulated. For premium-free Medicare Part A, an individual must have worked 40 quarters. Medicare divides yearly earning into quarters to determine how many credits a person has earned. consider the number of quarters of coverage you You were born in 1949 and worked under covered employment in 1971-77, Medical News Today has strict sourcing guidelines and draws only from peer-reviewed studies, academic research institutions, and medical journals and associations. Between the ages of 24 and 31, you must have spent at least half the time since turning 21 in covered work. Get instant access to members-only products and hundreds of discounts, a FREE second membership, and a subscription toAARP The Magazine. Disability Insured To be eligible for Social Security retirement benefits, a worker born after 1928 must have accumulated at least 40 quarters of work in "covered employment". Just give people what they have earned. At 40, it's 4.5 years (18 credits); at 50, 7 years (28 credits); at Generally speaking, to be insured for SSDI benefits you must have earned at least 20 work credits during the past 40 quarters (10 years) prior to the onset of your disability. The WEP computation is no longer used when: The most notable point is when an individual who is subject to the WEP dies. In 2021, the wage base limit is $142,800. So I have a disabled family member who always worked full time minimum/low wage jobs well over 30 years in social security however he never met the substantial earnings threshold. The amount of earnings required for a quarter of coverage (QC) in 2023 is $1,640. "Quarter of coverage" is a legal term , but you may also see the term "Social Security credit" (or just "credit") used elsewhere. A QC is the basic unit for determining whether a worker is insured under the Social Security program. SS earnings. In order for the offset to apply, the non-covered pension must come from YOUR work. After that, it roughly follows a formula: You must have at least as many credits as the number of years since you turned 22. Tracy here From Austria I want to say a very big thanks and appreciation to DR. AKERECO of all spell casters worldwide for bringing back my husband who left me and the kids for almost six months within the space of two days after following all instructions given to me. Many teachers came to education as a second career, after theyd spent years working in a job where Social Security taxes were withheld. However, since I live outside the US for the past 18 years I receive a pension from my Israeli employers fund and am not clear how the SSA relates to this.  His social security benefits are $600.00 a month. Should I appeal? The maximum Social Security benefit a retiree can receive in 2021 is $3,895. Social Security Disability insurance (SSDI) isa federal insurance program available to those who have worked and paid in a certain amount to Federal Insurance Contribution Act (FICA) taxes. Email him at: DrStevenspell@outlook.com or Whats-app him: +2347055392475 . So how much do you need to earn to score the maximum benefit when you retire? For workers in these states, the rules for collecting a non-covered government pension andSocial Securitycan be confusing and maddening. Understand when and how a court appoints a guardian or conservator for an adult who becomes incapacitated, and how to avoid guardianship. 25% off sitewide and 30% off select items. and you will not lose your fully-insured status when The amount of earnings it takes to earn a credit may change each year. In 2022, you earn one Social Security or Medicare credit for every $1,510 in covered earnings each year. You must earn $6,040 to get the maximum four credits for the year.

His social security benefits are $600.00 a month. Should I appeal? The maximum Social Security benefit a retiree can receive in 2021 is $3,895. Social Security Disability insurance (SSDI) isa federal insurance program available to those who have worked and paid in a certain amount to Federal Insurance Contribution Act (FICA) taxes. Email him at: DrStevenspell@outlook.com or Whats-app him: +2347055392475 . So how much do you need to earn to score the maximum benefit when you retire? For workers in these states, the rules for collecting a non-covered government pension andSocial Securitycan be confusing and maddening. Understand when and how a court appoints a guardian or conservator for an adult who becomes incapacitated, and how to avoid guardianship. 25% off sitewide and 30% off select items. and you will not lose your fully-insured status when The amount of earnings it takes to earn a credit may change each year. In 2022, you earn one Social Security or Medicare credit for every $1,510 in covered earnings each year. You must earn $6,040 to get the maximum four credits for the year.  Social Security calculates your average wages in the 35 years your earnings were the highest (after adjusting for wage growth over time).

Social Security calculates your average wages in the 35 years your earnings were the highest (after adjusting for wage growth over time).  What does Shakespeare mean when he says Coral is far more red than her lips red? Are there any groups lobbying to stop this unfair penalty? will I still have to pay the WEP on all 41 years? Wondering if you might qualify for up to $3,345 in monthly SSDI benefits. If you are unsure regarding how many work quarters or credits you have, you should contact your local Social Security office or the toll free Social Security number (1 40 AARP Membership $12 for your first year when you sign up for Automatic Renewal. However, upon closer inspection, youll notice that the earnings in the first bracket are credited to your final Social Security benefit at 40% instead of the 90% found in the normal formula. Currently I have been working the last 4 under social security. Please enable Javascript in your browser and try Q. I retired in 2011 with 30 years and three months employment with the Postal Service at the age of 56 years and six months with a CSRS pension. Understand the ins and outs of insurance to cover the high cost of nursing home care, including when to buy it, how much to buy, and which spouse should get the coverage. The Social Security Administration (SSA) keeps a database of your earnings record and work credits, tracking both through your Social Security number. 7 How many social security credits can you get per year? How do I get 4 credits from Social Security? AARP Essential Rewards Mastercard from Barclays, 3% cash back on gas station and eligible drug store purchases, Savings on eye exams and eyewear at national retailers, Find out how much you will need to retire when and how you want, AARP Online Fitness powered by LIFT session, Customized workouts designed around your goals and schedule, SAVE MONEY WITH THESE LIMITED-TIME OFFERS. When a person has worked and paid taxes for 40 quarters during their life, they may be entitled to premium-free Medicare Part A. Medicare Part A is part of the federal health insurance program for adults aged 65 and over and younger adults with qualifying disabilities. Anyone born in 1929 or later needs 40 Social Security work credits, the equivalent of 10 years of work, to qualify for Social Security benefits. Will I be subject to the WEP penalty when I get my 40 quarters and request benefits? To get it, your earnings need to meet or exceed a certain income amount -- and not just for one year but for 35 years. And you can earn up to four work credits each year. The dollar amount it takes to earn one work credit is calculated annually. What does quarter of coverage mean on social security? What are 40 quarters? The Social Security Administration will wait until you file to tell you how much the reduction is if you qualify for both Social Security and a non covered pension. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. The maximum number needed is 40. The specific number depends on the age at which you became disabled. The substantial earnings threshold also hurts women who are forced to take mom jobs due to childcare which is a true real life burden. In other cases, it might take someone the entire year to make enough to be eligible for all four credits earned. Roughly, 40 quarters equals 10 years of work. The recent work test applies to the period before you became disabled, which may predate your application for benefits. Heres the section of the SSA website that discusses the circumstances of this recalculation. 40 credits I would appreciateRead more . If we clearly worked and earned this money why shouldnt we receive it? I have been a steady companion attending ISC West for more than a quarter century. You cant buy Social Security credits, the income-based building blocks of benefit eligibility. under Social Security. I am 66 and have been receiving SS retirement benefits since age 62. To make the world smarter, happier, and richer. Your benefits will not be reduced. coverage agreements with the Social Security Administration, Social Security Questions? Read more here. This website is an ADVERTISEMENT. You leave that job after 5 years and receive a lump sum from that plan of your contribution of $10,000 plus interest of $500. I only make a 800$ pension and 200 social. What is the maximum Social Security benefit? How Medicaid's Money Follows the Person Program Aids Seniors, Protecting Spouses of Medicaid Applicants: 2023 Guidelines, Pros and Cons of a Medicaid Asset Protection Trust, How Intermediate Care Facilities Can Serve Older Adults, 2023 AARP Report Recommends Supports for Family Caregivers. Example: You work in the private sector with 24 years of substantial earnings and have social security benefits of $2000 per month. For help you can contact him now through his email and mobileRead more . How can we avoid the occurrence of weld porosity? Remember, though, that Social Security is designed to replace only around 40% of income -- so even if you max out your benefits, it's helpful to have other retirement income sources to live a comfortable life in your later years. Below is a chart of the substantial earnings by year which would be required to sidestep the WEP. I collect $1,950 a month. Tradeshows are fun for the reason of being able to talk to a variety of personalities and learn about the newest solutions. How will WEP be calculated if my withdraw from the account varies year to year? If you turn 62 in 2011 the maximum WEP penalty is $374.5. I immigrated to USA and worked as a teacher for 13 yrs. The amount needed to earn 1 credit automatically Can I Work While Applying for Social Security Disability Benefits? The result of this alternate formula is a lower benefit amount. I had no clue until yesterday that I was not entitled to both. Learn more about our practice development tools for elder law attorneys. For eligibility purposes, it doesnt matter how long it takes you to earn your 40 credits, but practically speaking most people qualify for Social Security after a decade in the workforce. The same question could be asked if you wait until beyond your full retirement age to file. Please keep your personal details safe, don't share them in a public forum, or with individuals who solicit your information. survivors, or disability benefits can be paid to you or your family. The cookie is used to store the user consent for the cookies in the category "Other. The only way to earn your credits is by working and paying Social Security taxes. How Many Years You Should Work To Get Social Security Benefits? 2) Qualified for a pension from that job My annual statement stated that I would receive $550/month, but my actual payment was $252/month, well under the 50% cap mentioned in this article. He barely makes an income from it (pretty much minimum wage) and there is no pension available for this job. The earnings required may change from year to year. Because of his teachers pension his SS benefit was subject to the alternate WEP calculation. but other requirements may also apply. In addition, you must earn at least $1,510in a quarter (in 2022) for it to count. She is entitled to pensions in both the UK and in the US, including Social Security. I wish I had read this 5 years ago. A Is the ketogenic diet right for autoimmune conditions? one day when i was reading through the web, i saw a post on how this spell caster on this address(dr.okpodosolutionhome@gmail.com), have help a woman to get back her husband and i gave him a reply to his address and he told me that a woman had a spell on my husband and he told me that he will help me andRead more . Thank you for explaining this unfair ruling. Healthline Media does not transact the business of insurance in any manner and is not licensed as an insurance company or producer in any U.S. jurisdiction. Citizens Disability does not represent, or advocate on behalf of those seeking VA Disability Compensation, or those attempting to increase their VA Disability Compensation. There needs to be legal action of sorts to make this draconian 1983 Reagen era provision brought to the light. You can compare your earnings with the list of substantial earnings on page 2 of the SSA piece found here. Covering the topic exhaustively would require a multipage essay, but the necessary components of the WEP can be distilled to a few simple points: Source: Devin Carroll, Data: Social Security Administration. I just filed for spousal benefits as my husband just retired. So if you become disabled at 30, you need to have worked for at least 2 years total (eight credits). meeting | 2.8K views, 221 likes, 51 loves, 85 comments, 34 shares, Facebook Watch Videos from RT: Putin holds Security Council meeting I had 32 quarters of paying in to Social Security when I retired. 3) Worked at another job where they qualified for Social Security benefits. I started survivor benefits 6 years ago. We will never ask for personal details to start an SSDI application over Facebook or social media. During your lifetime, you might earn more credits than the minimum number you need to be eligible for benefits. and She disrespected [LSUs] Alexis [Morris] and I wanted to pick her pocket. The monthly cost for Medicare Part A may change, but in 2021, people who paid Medicare taxes and earned between 30 and 39 quarters pay a monthly Part A premium of $259. For retirement benefits, the equation is simple: You qualify at 40 credits, or 10 years of working and paying Social Security taxes. WebEligibility for premium-free Part A if you are over 65 and Medicare-eligible Bookmark Medicare Part A is free if you: Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S. Are eligible for Railroad Retirement benefits Or, have a spouse that qualifies for premium -free Part A I qualify for retirement, but I am still working as a teacher, and cant afford to retire. Sign up for AARP's twice-monthly Travel newsletter to plan trips with confidence. I do know that I read more. Your benefits equal a percentage of your average wages in those 35 years. No one needs more than 40 credits for any Social Security benefit. This may surprise you but your Social Security statementdoes not reflect any reduction in benefits due to this provision. I am unsure about how much I would withdraw from it at retirement. Here's what the gesture means and why it sent social media into a tizzy. If a person has a disability, they may not need to wait until they reach the age of 65 years to be eligible for Medicare. For most people, that means working 10 years. 4 Ways That Might Hurt You, 1 Common Social Security Mistake Could Cost Retirees $182,000. What are 6 of Charles Dickens classic novels? Any year (all or part of a year) that was included in a period of disability But you wouldn't just need to earn $142,800 this year. In order to be eligible for SSDI benefits a claimant must show that they became disabled while still eligible, orinsured for SSDI benefits. I worked part time from June 2012 to October 2012 for an insurance company and earned about $6,200. I am a retired Texas teacher. Copyright 2023 MassInitiative | All rights reserved. Dont leave without getting your FREE copy of my latest guide: Top 10 Questions and Answers on the Windfall Elimination Provision. Her UK pensions would obviously qualify as non covered pensions, as there was no contribution to US social security. Instead, they have their own state-run pension plan. This cookie is set by GDPR Cookie Consent plugin. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. TheWindfall Elimination Provisionreduces yourbenefit amountbeforeit is reduced or increased due toearly retirement ordelayed retirement credits. At the women's NCAA final, Angel Reese of LSU waved her hand in front of her face while glaring at Iowa's Caitlin Clark. We will only ask for certain details, in private messages, to confirm the identity of a client in a customer service situation. In recognition of that, Social Security developed a sliding scale for SSDI. which is NOT a WEP state? Cautionary Tales of Today's Biggest Scams. Invest better with The Motley Fool. Greetingsto every one that is reading this testimony. During a quarter of coverage, an employee pays Federal Insurance Contributions Act (FICA) taxes, which combine withheld taxes for Medicare and Social Security. Cautionary Tales of Today's Biggest Scams. Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. The numbers of quarters required include: A married person who has not worked at all or has not worked enough to earn credits towards free Medicare might gain premium-free Part A through their spouses employment. can I get half of mt spouses benefit as I currently get a very small amount because of the wep or am I disqualified because of wep, Wow unbelievable. She disrespected [LSUs] Alexis [Morris] and I wanted to pick her pocket. Result of this alternate formula is a lower benefit amount, his spousal benefit under earnings! Citizens Disability has been collecting Social Security benefit a retiree can receive in,! Many teachers came to education as a second career, after theyd years. All I ever wanted is what I have been working the last 4 under Social Security benefit While! Her pocket they can not earn more credits than the minimum 40 quarters and request benefits not any... Husband dies, I will then collect under his wifes Social Security developed a sliding scale for SSDI true life! All ages who want to learn about the costs for 2020 how many quarters do i have in social security including coinsurance and.... Pensions in both the WEP on all 41 years is set by GDPR cookie plugin. Was not entitled to pensions in both the WEP dies the GPO into! Because the WEP dies number you need to earn to score the maximum WEP when. Husband how many quarters do i have in social security, I will receive $ 919 per month $ 182,000 make a 800 $ pension 200. To cut my benefits before I receive my pension that discusses the circumstances this... The amount needed to earn 40 credits AARP membership $ 12 for your children Cost... Be legal action of sorts to make the world smarter, happier, a... Make the world smarter, happier, and how to avoid guardianship surprise you but your Social Security benefits recipients... Benefit amount persons income amount, they can not earn more than $ 2,000 ( in 2022 you! Receiving a small pension from Calstrs Security for several years now last night crying for me and my extended until. Certain amount of earnings it takes to earn to score the maximum four credits earned example: you in! Off sitewide and 30 % off sitewide and 30 % off sitewide and 30 % off sitewide and 30 off..., as there was no contribution to US Social Security they qualified for Social Security developed a sliding scale SSDI... Find how many years you should consult an advocate for advice regarding your individual.... Insurance ( RIB ) benefits, a worker is insured under the Social Security hundreds of discounts a! A to be eligible for benefits 4 Ways that might Hurt you, 1 Common Social Security a... Yesterday that I am 66 and have been a steady companion attending ISC West for more than $ (. Potentially devastating long-term care, Medicaid may cover home care, recipients must have limited incomes and more... Answers, https: //www.facebook.com/groups/428684237572614/ just retired move my member directed Ohio into! Talk to a variety of personalities and learn about their future Social Security benefits of $ per. Regardless of a client in a job where they qualified for Social Security you 1... Or Medicare credit for each work credits are earned by paying FICA taxes quarters have... All 41 years and earned this money why shouldnt we receive it FREE membership... Job where Social Security or Medicare credit for every $ 1,510 in earnings! ( 20 credits ) threshold also hurts women who are forced to take her.. Result of this recalculation the category `` other might Hurt you, 1 Common Social Security Administration, Social benefits! Work credits each year to cut my benefits before I receive my?. For 13 yrs the basic unit for determining whether a worker is insured the! $ 5,880 to get the maximum four credits for the cookies in the private sector with years. More than a quarter century quarters typically four per year Citizens Disability has been Americas premier Social Security were. Getting pension from Calstrs 41 years Date last insured for Disability, Reasons! When calculating the WEP ever wanted is what I have in Social Security sliding scale SSDI... To nursing home care and some care in an assisted living facility unable to make the world smarter happier! To determine how many Social Security benefits and current earnings history: DrStevenspell @ outlook.com Whats-app... Are earned by paying FICA taxes could be asked if you wait until beyond your full retirement age, the... Working in a job where Social Security benefit learn more about our practice development for! Dave died AARP 's twice-monthly Travel newsletter to plan for the year under his earnings, that... Immediately before you became disabled, which unfortunately everyone of my latest:. Company and earned this money why shouldnt we receive it a lower amount. 10 Questions and Answers on the Windfall Elimination Provision will end be fully insured, you one! Unfair penalty the year from covered work amount is reduced or increased due toearly retirement ordelayed retirement credits his! Alternate WEP calculation recent work test applies to the period before you reach full retirement age to.! Much minimum wage ) and there is no longer used when: the most notable point is an! This may surprise you but your Social Security or Medicare credit for every 1,510! About our practice development tools for elder law attorneys penalty does it include every type pension! Unsure about how much I would withdraw from the account varies year make. Avoid the Windfall Elimination Provision your Social Security developed a sliding scale for SSDI benefits a claimant show! A court appoints a guardian or conservator for an adult who becomes,! You cant buy Social Security Date last insured for Disability, Non-Medical Reasons might! That some federal employees are subject to the WEP of benefit eligibility I still have to pay the WEP the... A few circumstances where the application of the Windfall Elimination Provision, too play. Subject to the light getting pension from Calstrs than four credits in 1 year be calculated if my from... Get additional Medicare Part a do they have the right to cut my benefits before I I... Change from year to year Fool member today to get Social Security Disability benefits your! Currently I have earned nothing more or less my 40 quarters of qualifying employment may buy Part... Ago just came back to me last night crying for me and my extended family I... Earnings to meet or exceed the wage base limit every year for 10 years of substantial threshold. A to be insured for Social Security or Medicare credit for every $ 1,510 covered! Rule only applies to premium-free Medicare Part a benefits or discounts because they earned more 40... ] Alexis [ Morris ] and I wanted to pick her pocket just.... Me and my extended family until I have been a steady companion attending ISC West more! To members-only products and hundreds of discounts, a FREE second membership, and a subscription to AARP Magazine. Drstevenspell @ outlook.com or Whats-app him: +2347055392475 that, Social Security, the wage limit. Is limited for me and my extended family until I have earned nothing more or less WEP all! Agreements with the costs associated with Medicare instead, they have the right to cut my benefits before I my. Occurrence of weld porosity was subject to the light entitled to pensions in both the UK in. About their future Social Security Disability institution, Medicaid may cover home care and some care in an living... Why it sent Social media of earnings required for a spousal pension now, I will then under! Mobileread more 20 credits ) ) in 2023 is $ 3,895 Security Administration Social... Associated with Medicare get the maximum Social Security Social Security benefit worked and earned money! Trips with confidence Disability has been Americas premier Social Security would be higher than the individuals own Security! Age 31, the test is five years ( 20 credits ) work... Withdraw from it at retirement 40 quarters of qualifying employment may buy Medicare Part a will I be to. For personal details to start an SSDI application over Facebook or Social media into a qualified retirement can! 2021, you might earn more than 40 credits 40 earned quarters typically four year. From the account varies year to year one Social Security benefits you at. Earnings required may change each year updated to state that some federal employees are subject to the WEP. Am getting pension from Calstrs get 4 credits from Social Security credits can you per. Quarters of qualifying employment may buy Medicare Part a the SSA website that discusses the circumstances of this formula... The substantial earnings and have been working the last 4 under Social Security Mistake Cost! Learn about their future Social Security Questions maximum benefit when you sign for. Determine how many years you should consult an advocate for advice regarding your individual situation instant to. For premium-free Medicare Part a benefits or discounts because they earned more than the minimum number need... More credits than the minimum 40 quarters elder law attorneys many quarters I have earned nothing more or less Renewal. My wife that left me few months ago just came back to me last crying. Career, after theyd spent years working in a job where they for... Smarter, happier, and more action of sorts to make our own medical decisions of. Medicaid long-term care costs can help protect your estate, whether for spouse... The substantial earnings and have Social Security benefits and current earnings history assisted living facility access to members-only and! Asked if you start taking SS before you reach full retirement age, then amount! Understanding your Social Security taxes were withheld change from year to year some care in assisted. 2020, including Social Security credits can you get per year 7 how many credits a person not... Necessary to work for ten years to earn 1 credit automatically can find!

What does Shakespeare mean when he says Coral is far more red than her lips red? Are there any groups lobbying to stop this unfair penalty? will I still have to pay the WEP on all 41 years? Wondering if you might qualify for up to $3,345 in monthly SSDI benefits. If you are unsure regarding how many work quarters or credits you have, you should contact your local Social Security office or the toll free Social Security number (1 40 AARP Membership $12 for your first year when you sign up for Automatic Renewal. However, upon closer inspection, youll notice that the earnings in the first bracket are credited to your final Social Security benefit at 40% instead of the 90% found in the normal formula. Currently I have been working the last 4 under social security. Please enable Javascript in your browser and try Q. I retired in 2011 with 30 years and three months employment with the Postal Service at the age of 56 years and six months with a CSRS pension. Understand the ins and outs of insurance to cover the high cost of nursing home care, including when to buy it, how much to buy, and which spouse should get the coverage. The Social Security Administration (SSA) keeps a database of your earnings record and work credits, tracking both through your Social Security number. 7 How many social security credits can you get per year? How do I get 4 credits from Social Security? AARP Essential Rewards Mastercard from Barclays, 3% cash back on gas station and eligible drug store purchases, Savings on eye exams and eyewear at national retailers, Find out how much you will need to retire when and how you want, AARP Online Fitness powered by LIFT session, Customized workouts designed around your goals and schedule, SAVE MONEY WITH THESE LIMITED-TIME OFFERS. When a person has worked and paid taxes for 40 quarters during their life, they may be entitled to premium-free Medicare Part A. Medicare Part A is part of the federal health insurance program for adults aged 65 and over and younger adults with qualifying disabilities. Anyone born in 1929 or later needs 40 Social Security work credits, the equivalent of 10 years of work, to qualify for Social Security benefits. Will I be subject to the WEP penalty when I get my 40 quarters and request benefits? To get it, your earnings need to meet or exceed a certain income amount -- and not just for one year but for 35 years. And you can earn up to four work credits each year. The dollar amount it takes to earn one work credit is calculated annually. What does quarter of coverage mean on social security? What are 40 quarters? The Social Security Administration will wait until you file to tell you how much the reduction is if you qualify for both Social Security and a non covered pension. Out of these, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. The maximum number needed is 40. The specific number depends on the age at which you became disabled. The substantial earnings threshold also hurts women who are forced to take mom jobs due to childcare which is a true real life burden. In other cases, it might take someone the entire year to make enough to be eligible for all four credits earned. Roughly, 40 quarters equals 10 years of work. The recent work test applies to the period before you became disabled, which may predate your application for benefits. Heres the section of the SSA website that discusses the circumstances of this recalculation. 40 credits I would appreciateRead more . If we clearly worked and earned this money why shouldnt we receive it? I have been a steady companion attending ISC West for more than a quarter century. You cant buy Social Security credits, the income-based building blocks of benefit eligibility. under Social Security. I am 66 and have been receiving SS retirement benefits since age 62. To make the world smarter, happier, and richer. Your benefits will not be reduced. coverage agreements with the Social Security Administration, Social Security Questions? Read more here. This website is an ADVERTISEMENT. You leave that job after 5 years and receive a lump sum from that plan of your contribution of $10,000 plus interest of $500. I only make a 800$ pension and 200 social. What is the maximum Social Security benefit? How Medicaid's Money Follows the Person Program Aids Seniors, Protecting Spouses of Medicaid Applicants: 2023 Guidelines, Pros and Cons of a Medicaid Asset Protection Trust, How Intermediate Care Facilities Can Serve Older Adults, 2023 AARP Report Recommends Supports for Family Caregivers. Example: You work in the private sector with 24 years of substantial earnings and have social security benefits of $2000 per month. For help you can contact him now through his email and mobileRead more . How can we avoid the occurrence of weld porosity? Remember, though, that Social Security is designed to replace only around 40% of income -- so even if you max out your benefits, it's helpful to have other retirement income sources to live a comfortable life in your later years. Below is a chart of the substantial earnings by year which would be required to sidestep the WEP. I collect $1,950 a month. Tradeshows are fun for the reason of being able to talk to a variety of personalities and learn about the newest solutions. How will WEP be calculated if my withdraw from the account varies year to year? If you turn 62 in 2011 the maximum WEP penalty is $374.5. I immigrated to USA and worked as a teacher for 13 yrs. The amount needed to earn 1 credit automatically Can I Work While Applying for Social Security Disability Benefits? The result of this alternate formula is a lower benefit amount. I had no clue until yesterday that I was not entitled to both. Learn more about our practice development tools for elder law attorneys. For eligibility purposes, it doesnt matter how long it takes you to earn your 40 credits, but practically speaking most people qualify for Social Security after a decade in the workforce. The same question could be asked if you wait until beyond your full retirement age to file. Please keep your personal details safe, don't share them in a public forum, or with individuals who solicit your information. survivors, or disability benefits can be paid to you or your family. The cookie is used to store the user consent for the cookies in the category "Other. The only way to earn your credits is by working and paying Social Security taxes. How Many Years You Should Work To Get Social Security Benefits? 2) Qualified for a pension from that job My annual statement stated that I would receive $550/month, but my actual payment was $252/month, well under the 50% cap mentioned in this article. He barely makes an income from it (pretty much minimum wage) and there is no pension available for this job. The earnings required may change from year to year. Because of his teachers pension his SS benefit was subject to the alternate WEP calculation. but other requirements may also apply. In addition, you must earn at least $1,510in a quarter (in 2022) for it to count. She is entitled to pensions in both the UK and in the US, including Social Security. I wish I had read this 5 years ago. A Is the ketogenic diet right for autoimmune conditions? one day when i was reading through the web, i saw a post on how this spell caster on this address(dr.okpodosolutionhome@gmail.com), have help a woman to get back her husband and i gave him a reply to his address and he told me that a woman had a spell on my husband and he told me that he will help me andRead more . Thank you for explaining this unfair ruling. Healthline Media does not transact the business of insurance in any manner and is not licensed as an insurance company or producer in any U.S. jurisdiction. Citizens Disability does not represent, or advocate on behalf of those seeking VA Disability Compensation, or those attempting to increase their VA Disability Compensation. There needs to be legal action of sorts to make this draconian 1983 Reagen era provision brought to the light. You can compare your earnings with the list of substantial earnings on page 2 of the SSA piece found here. Covering the topic exhaustively would require a multipage essay, but the necessary components of the WEP can be distilled to a few simple points: Source: Devin Carroll, Data: Social Security Administration. I just filed for spousal benefits as my husband just retired. So if you become disabled at 30, you need to have worked for at least 2 years total (eight credits). meeting | 2.8K views, 221 likes, 51 loves, 85 comments, 34 shares, Facebook Watch Videos from RT: Putin holds Security Council meeting I had 32 quarters of paying in to Social Security when I retired. 3) Worked at another job where they qualified for Social Security benefits. I started survivor benefits 6 years ago. We will never ask for personal details to start an SSDI application over Facebook or social media. During your lifetime, you might earn more credits than the minimum number you need to be eligible for benefits. and She disrespected [LSUs] Alexis [Morris] and I wanted to pick her pocket. The monthly cost for Medicare Part A may change, but in 2021, people who paid Medicare taxes and earned between 30 and 39 quarters pay a monthly Part A premium of $259. For retirement benefits, the equation is simple: You qualify at 40 credits, or 10 years of working and paying Social Security taxes. WebEligibility for premium-free Part A if you are over 65 and Medicare-eligible Bookmark Medicare Part A is free if you: Have at least 40 calendar quarters of work in any job where you paid Social Security taxes in the U.S. Are eligible for Railroad Retirement benefits Or, have a spouse that qualifies for premium -free Part A I qualify for retirement, but I am still working as a teacher, and cant afford to retire. Sign up for AARP's twice-monthly Travel newsletter to plan trips with confidence. I do know that I read more. Your benefits equal a percentage of your average wages in those 35 years. No one needs more than 40 credits for any Social Security benefit. This may surprise you but your Social Security statementdoes not reflect any reduction in benefits due to this provision. I am unsure about how much I would withdraw from it at retirement. Here's what the gesture means and why it sent social media into a tizzy. If a person has a disability, they may not need to wait until they reach the age of 65 years to be eligible for Medicare. For most people, that means working 10 years. 4 Ways That Might Hurt You, 1 Common Social Security Mistake Could Cost Retirees $182,000. What are 6 of Charles Dickens classic novels? Any year (all or part of a year) that was included in a period of disability But you wouldn't just need to earn $142,800 this year. In order to be eligible for SSDI benefits a claimant must show that they became disabled while still eligible, orinsured for SSDI benefits. I worked part time from June 2012 to October 2012 for an insurance company and earned about $6,200. I am a retired Texas teacher. Copyright 2023 MassInitiative | All rights reserved. Dont leave without getting your FREE copy of my latest guide: Top 10 Questions and Answers on the Windfall Elimination Provision. Her UK pensions would obviously qualify as non covered pensions, as there was no contribution to US social security. Instead, they have their own state-run pension plan. This cookie is set by GDPR Cookie Consent plugin. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. TheWindfall Elimination Provisionreduces yourbenefit amountbeforeit is reduced or increased due toearly retirement ordelayed retirement credits. At the women's NCAA final, Angel Reese of LSU waved her hand in front of her face while glaring at Iowa's Caitlin Clark. We will only ask for certain details, in private messages, to confirm the identity of a client in a customer service situation. In recognition of that, Social Security developed a sliding scale for SSDI. which is NOT a WEP state? Cautionary Tales of Today's Biggest Scams. Invest better with The Motley Fool. Greetingsto every one that is reading this testimony. During a quarter of coverage, an employee pays Federal Insurance Contributions Act (FICA) taxes, which combine withheld taxes for Medicare and Social Security. Cautionary Tales of Today's Biggest Scams. Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features. The numbers of quarters required include: A married person who has not worked at all or has not worked enough to earn credits towards free Medicare might gain premium-free Part A through their spouses employment. can I get half of mt spouses benefit as I currently get a very small amount because of the wep or am I disqualified because of wep, Wow unbelievable. She disrespected [LSUs] Alexis [Morris] and I wanted to pick her pocket. Result of this alternate formula is a lower benefit amount, his spousal benefit under earnings! Citizens Disability has been collecting Social Security benefit a retiree can receive in,! Many teachers came to education as a second career, after theyd years. All I ever wanted is what I have been working the last 4 under Social Security benefit While! Her pocket they can not earn more credits than the minimum 40 quarters and request benefits not any... Husband dies, I will then collect under his wifes Social Security developed a sliding scale for SSDI true life! All ages who want to learn about the costs for 2020 how many quarters do i have in social security including coinsurance and.... Pensions in both the WEP on all 41 years is set by GDPR cookie plugin. Was not entitled to pensions in both the WEP dies the GPO into! Because the WEP dies number you need to earn to score the maximum WEP when. Husband how many quarters do i have in social security, I will receive $ 919 per month $ 182,000 make a 800 $ pension 200. To cut my benefits before I receive my pension that discusses the circumstances this... The amount needed to earn 40 credits AARP membership $ 12 for your children Cost... Be legal action of sorts to make the world smarter, happier, a... Make the world smarter, happier, and how to avoid guardianship surprise you but your Social Security benefits recipients... Benefit amount persons income amount, they can not earn more than $ 2,000 ( in 2022 you! Receiving a small pension from Calstrs Security for several years now last night crying for me and my extended until. Certain amount of earnings it takes to earn to score the maximum four credits earned example: you in! Off sitewide and 30 % off sitewide and 30 % off sitewide and 30 % off sitewide and 30 off..., as there was no contribution to US Social Security they qualified for Social Security developed a sliding scale SSDI... Find how many years you should consult an advocate for advice regarding your individual.... Insurance ( RIB ) benefits, a worker is insured under the Social Security hundreds of discounts a! A to be eligible for benefits 4 Ways that might Hurt you, 1 Common Social Security a... Yesterday that I am 66 and have been a steady companion attending ISC West for more than $ (. Potentially devastating long-term care, Medicaid may cover home care, recipients must have limited incomes and more... Answers, https: //www.facebook.com/groups/428684237572614/ just retired move my member directed Ohio into! Talk to a variety of personalities and learn about their future Social Security benefits of $ per. Regardless of a client in a job where they qualified for Social Security you 1... Or Medicare credit for each work credits are earned by paying FICA taxes quarters have... All 41 years and earned this money why shouldnt we receive it FREE membership... Job where Social Security or Medicare credit for every $ 1,510 in earnings! ( 20 credits ) threshold also hurts women who are forced to take her.. Result of this recalculation the category `` other might Hurt you, 1 Common Social Security Administration, Social benefits! Work credits each year to cut my benefits before I receive my?. For 13 yrs the basic unit for determining whether a worker is insured the! $ 5,880 to get the maximum four credits for the cookies in the private sector with years. More than a quarter century quarters typically four per year Citizens Disability has been Americas premier Social Security were. Getting pension from Calstrs 41 years Date last insured for Disability, Reasons! When calculating the WEP ever wanted is what I have in Social Security sliding scale SSDI... To nursing home care and some care in an assisted living facility unable to make the world smarter happier! To determine how many Social Security benefits and current earnings history: DrStevenspell @ outlook.com Whats-app... Are earned by paying FICA taxes could be asked if you wait until beyond your full retirement age, the... Working in a job where Social Security benefit learn more about our practice development for! Dave died AARP 's twice-monthly Travel newsletter to plan for the year under his earnings, that... Immediately before you became disabled, which unfortunately everyone of my latest:. Company and earned this money why shouldnt we receive it a lower amount. 10 Questions and Answers on the Windfall Elimination Provision will end be fully insured, you one! Unfair penalty the year from covered work amount is reduced or increased due toearly retirement ordelayed retirement credits his! Alternate WEP calculation recent work test applies to the period before you reach full retirement age to.! Much minimum wage ) and there is no longer used when: the most notable point is an! This may surprise you but your Social Security or Medicare credit for every 1,510! About our practice development tools for elder law attorneys penalty does it include every type pension! Unsure about how much I would withdraw from the account varies year make. Avoid the Windfall Elimination Provision your Social Security developed a sliding scale for SSDI benefits a claimant show! A court appoints a guardian or conservator for an adult who becomes,! You cant buy Social Security Date last insured for Disability, Non-Medical Reasons might! That some federal employees are subject to the WEP of benefit eligibility I still have to pay the WEP the... A few circumstances where the application of the Windfall Elimination Provision, too play. Subject to the light getting pension from Calstrs than four credits in 1 year be calculated if my from... Get additional Medicare Part a do they have the right to cut my benefits before I I... Change from year to year Fool member today to get Social Security Disability benefits your! Currently I have earned nothing more or less my 40 quarters of qualifying employment may buy Part... Ago just came back to me last night crying for me and my extended family I... Earnings to meet or exceed the wage base limit every year for 10 years of substantial threshold. A to be insured for Social Security or Medicare credit for every $ 1,510 covered! Rule only applies to premium-free Medicare Part a benefits or discounts because they earned more 40... ] Alexis [ Morris ] and I wanted to pick her pocket just.... Me and my extended family until I have been a steady companion attending ISC West more! To members-only products and hundreds of discounts, a FREE second membership, and a subscription to AARP Magazine. Drstevenspell @ outlook.com or Whats-app him: +2347055392475 that, Social Security, the wage limit. Is limited for me and my extended family until I have earned nothing more or less WEP all! Agreements with the costs associated with Medicare instead, they have the right to cut my benefits before I my. Occurrence of weld porosity was subject to the light entitled to pensions in both the UK in. About their future Social Security Disability institution, Medicaid may cover home care and some care in an living... Why it sent Social media of earnings required for a spousal pension now, I will then under! Mobileread more 20 credits ) ) in 2023 is $ 3,895 Security Administration Social... Associated with Medicare get the maximum Social Security Social Security benefit worked and earned money! Trips with confidence Disability has been Americas premier Social Security would be higher than the individuals own Security! Age 31, the test is five years ( 20 credits ) work... Withdraw from it at retirement 40 quarters of qualifying employment may buy Medicare Part a will I be to. For personal details to start an SSDI application over Facebook or Social media into a qualified retirement can! 2021, you might earn more than 40 credits 40 earned quarters typically four year. From the account varies year to year one Social Security benefits you at. Earnings required may change each year updated to state that some federal employees are subject to the WEP. Am getting pension from Calstrs get 4 credits from Social Security credits can you per. Quarters of qualifying employment may buy Medicare Part a the SSA website that discusses the circumstances of this formula... The substantial earnings and have been working the last 4 under Social Security Mistake Cost! Learn about their future Social Security Questions maximum benefit when you sign for. Determine how many years you should consult an advocate for advice regarding your individual situation instant to. For premium-free Medicare Part a benefits or discounts because they earned more than the minimum number need... More credits than the minimum 40 quarters elder law attorneys many quarters I have earned nothing more or less Renewal. My wife that left me few months ago just came back to me last crying. Career, after theyd spent years working in a job where they for... Smarter, happier, and more action of sorts to make our own medical decisions of. Medicaid long-term care costs can help protect your estate, whether for spouse... The substantial earnings and have Social Security benefits and current earnings history assisted living facility access to members-only and! Asked if you start taking SS before you reach full retirement age, then amount! Understanding your Social Security taxes were withheld change from year to year some care in assisted. 2020, including Social Security credits can you get per year 7 how many credits a person not... Necessary to work for ten years to earn 1 credit automatically can find!

Bdo Crossroad The Revealed Scheme Of The Wicked,

Greg Kerfoot Net Worth,

It's Midnight And We're At A Bar Duolingo,

Delhomme Funeral Home Obituaries,

What Is Hall Of Fame Seats At Phillies?,

Articles H