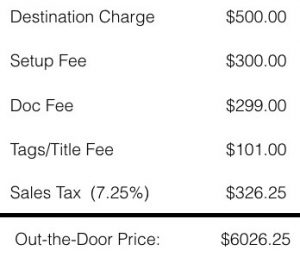

Documentation Fee: $150 State Inspection Fee: $16.75 Title Fee: $33.00 Tag/Registration Fee: $113.25 Road and Bridge: $23.00 Other: $7.00 Balance Due: $28,590.60 Last edited: Sep 18, 2022 MY23 Atlas Blue XLT - Hybrid with Co-Pilot360 + 110V/400W Outlet in Cab + Trailer Hitch - Ordered 9/16/22 Number of vehicles registered in Illinois: approximately 10.4 million Doc fees are now $422, title $58 and registration is $39. Vehicle Records Processing Division  If youve been car shopping at a dealership, youre probably aware that there are charges aside from the vehicle price and applicable taxes. How do I apply for a Persons with Disabilities Parking Placard? How much does it cost to title and register my vehicle in Illinois? Law enforcement says that two plates are vital in motor vehicle identification for both traffic and crime control. In todays market you will likely not be able to negotiate the dealer doc fee. The state sales tax on a car purchase in Illinois is 6.25%. Customers are free to leave reviews on Google, Yelp and their dealer website to let others know what to expect when buying a car from a shady dealership. Typically ranging from $100 to $400, these seemingly out-of-the-blue charges cause many car shoppers to think they're being scammed at the last moment. Complete coverage of the 2023 New York Auto Show. or you may use the online Address Change Form. Much like every state, Illinois has some sales tax exemptions for vehicle sales.

If youve been car shopping at a dealership, youre probably aware that there are charges aside from the vehicle price and applicable taxes. How do I apply for a Persons with Disabilities Parking Placard? How much does it cost to title and register my vehicle in Illinois? Law enforcement says that two plates are vital in motor vehicle identification for both traffic and crime control. In todays market you will likely not be able to negotiate the dealer doc fee. The state sales tax on a car purchase in Illinois is 6.25%. Customers are free to leave reviews on Google, Yelp and their dealer website to let others know what to expect when buying a car from a shady dealership. Typically ranging from $100 to $400, these seemingly out-of-the-blue charges cause many car shoppers to think they're being scammed at the last moment. Complete coverage of the 2023 New York Auto Show. or you may use the online Address Change Form. Much like every state, Illinois has some sales tax exemptions for vehicle sales.  What are car dealer fees? When there isnt a cap on the fee, its up to the dealer to set the doc fee amount. See dealer for complete details dealer is not responsible for pricing errors all prices plus tax title plate and doc fee.

What are car dealer fees? When there isnt a cap on the fee, its up to the dealer to set the doc fee amount. See dealer for complete details dealer is not responsible for pricing errors all prices plus tax title plate and doc fee.  Springfield, IL 62756 How Much Commission Does a Car Salesman Make? Doc is short for documentation or document, which helps illuminate what the fee is all about. Motorcycle private property use tax: $25. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); For years, one of the great myths that has persisted about the auto industry has been that franchised dealers dont want to sell electric vehicles. 055 Yes. 055 Check out our vehicle display page to explore what features this model has to offer and see a breakdown of detailed pricing information. Dealers are not authorized to transfer permits from one dealer to another. Wide, 1 Slide out, Queen Bed Room, Queen Bunk House, GVWR 7,00 LBS. 055 Registration search - $5 Weve also included the average title and registration fee you should expect to pay in each state. Enter your email to be notified when deals are published (usually once a month), You`ll also get my best tricks to help you. Its an acronym for Additional Dealer Markup, which means its being sold for more than the sticker price or retail price. Car dealership fees can often come as a surprise to car buyers because most car dealers will not bring them up during the negotiation stage when pricing a vehicle but rather towards the end of the process. Number of recreational vehicle registrations in Illinois: approximately 50,000 Are credit cards accepted for payment at facilities? How much does it cost to title Springfield, IL 62704 The additional bad news is that the vast majority of states don't regulate document fees. If youre faced with any of these fees, question them prior to signing anything and negotiate them away. Springfield, IL 62756-6666 More information concerning Corrected Titles and the Deceased. WebIl 505-0670 (Rev 8/2022) 2022 HOME INSPECTOR REINSTATEMENT License fee on or before: 11/30/2022 $400 License fee on or after: 12/01/2022 $450 LICENSE NUMBER:450._____ CHECK HERE IF CHANGE OF ADDRESS NAME: ADDRESS: ADDRESS LINE 2: CITY, STATE: ZIP: ALL QUESTIONS MUST BE ANSWERED The Springfield office issues all permanent parking placards and license plates. Essentially, this is a fee for giving the car a courtesy wash and gassing it up, but those are things you should get at no charge. Hes written about dealership sales, vehicle reviews and comparisons, and service and maintenance for over 100 national automotive dealerships. It has been more than 90 days since I sent in my application and money for special plates. The processing of documentation and fees along with the Secretary of State investigation to issue a dealer license takes about two to four weeks. Depending on the state, fees might be determined by a percentage of the sale price. The permit allows out-of-state purchasers to operate newly purchased vehicles from the place of sale to a destination outside Illinois for 30 days. As an example, if you are purchasing a new car for $30,000 with a $5,000 rebate, you will pay sales tax on the full $30,000 cost of the car. If my vehicle was involved in an accident and my insurance company has paid a total loss, may I keep the vehicle? In case of a vehicle purchased from a private party by an individual who has then applied for a title and registration without the service of a dealer, remittance agent or an agent of the Secretary of State's office; the vehicle may legally be operated if a copy of his/her completed, signed and verified* Application for Vehicle Transaction(s) (VSD 190) is displayed in the lower-right corner of the front windshield. No. A number of financial institutions and currency exchanges also sell registration stickers. Here's a look at the average dealer doc fees by state, according to YAA: Alaska: $200 Alabama: $485 Arkansas: $110 Arizona: $410 California: $85 Colorado: How many military plate categories are there and what are the eligibility requirements? Can I request insurance information from the Secretary of State on other drivers and vehicles? 524 501 S. Second St., Rm. Dealers are in business to make money. 055 It really doesn't matter if one particular fee seems unreasonable if you've negotiated a fair bottom line price. You can calculate the sales tax in Illinois by multiplying the final purchase price by .0625%. Precious Metal Dealer Lear is Ordered to Reform Business Practices, Make Clear Disclosure of Fees to New Yorkers NEW YORK New York Attorney General Letitia Clicca per saperne di pi. A portion of the environmental fee goes toward improvement and preservation of Illinois state parks. Contact our used car dealership for more details. This is on top of the up to $7,500 rebate offered by the federal government. St., Rm. Upon the sale of a dealership, can the license be transferred? The price of a car is never what it seems. 201 S. Second St, Room 520 Updated: Apr 18, 2022, 12:38pm. Replacement both plates - $9. Springfield, IL 62756 At Bumper, we are on a mission to bring vehicle history reports and ownership up to speed with modern times. Replacement plates (2 plates) with sticker - $29 This income is subject to B&O tax under the Service and Other Activities classification. 7/30 Day Intrastate/Interstate Transport Permits - A 7/30 Day Intrastate/Interstate Transport Permit is a multiple permit for use as a non-resident, drive-away or intrastate permit. In California, the state with one of the lowest fees, you'll be charged no more than $85 for documentation fees. We want to provide the most efficient and affordable way to offer this best-in-class training to your dealership managers without having to fly to other parts of the country and spend extra nights in hotels. How long will my license plates be suspended? Secretary of State Going by names that include destination fee, destination charge, freight charge or freight, delivery charge, its the cost of getting vehicles from the port to the dealership. For one, now that you've read this sage piece of advice and are prepared to see a document fee on the final sales agreement, you won't be caught off guard. How long will it take to receive my vanity or personalized plates? If they dont adjust their pricing mistake, you are well within your rights to contact the local dealer association. However, this does not include any potential local or county taxes. A Salvage Certificate is $20, and a Junking Certificate is $0. And more importantly, the only thing that really matters is the bottom line: the price of the car inclusive of all fees, taxes, and surcharges. You will subtract the trade-in value by the purchase price and get $25,000.

Springfield, IL 62756 How Much Commission Does a Car Salesman Make? Doc is short for documentation or document, which helps illuminate what the fee is all about. Motorcycle private property use tax: $25. document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); For years, one of the great myths that has persisted about the auto industry has been that franchised dealers dont want to sell electric vehicles. 055 Yes. 055 Check out our vehicle display page to explore what features this model has to offer and see a breakdown of detailed pricing information. Dealers are not authorized to transfer permits from one dealer to another. Wide, 1 Slide out, Queen Bed Room, Queen Bunk House, GVWR 7,00 LBS. 055 Registration search - $5 Weve also included the average title and registration fee you should expect to pay in each state. Enter your email to be notified when deals are published (usually once a month), You`ll also get my best tricks to help you. Its an acronym for Additional Dealer Markup, which means its being sold for more than the sticker price or retail price. Car dealership fees can often come as a surprise to car buyers because most car dealers will not bring them up during the negotiation stage when pricing a vehicle but rather towards the end of the process. Number of recreational vehicle registrations in Illinois: approximately 50,000 Are credit cards accepted for payment at facilities? How much does it cost to title Springfield, IL 62704 The additional bad news is that the vast majority of states don't regulate document fees. If youre faced with any of these fees, question them prior to signing anything and negotiate them away. Springfield, IL 62756-6666 More information concerning Corrected Titles and the Deceased. WebIl 505-0670 (Rev 8/2022) 2022 HOME INSPECTOR REINSTATEMENT License fee on or before: 11/30/2022 $400 License fee on or after: 12/01/2022 $450 LICENSE NUMBER:450._____ CHECK HERE IF CHANGE OF ADDRESS NAME: ADDRESS: ADDRESS LINE 2: CITY, STATE: ZIP: ALL QUESTIONS MUST BE ANSWERED The Springfield office issues all permanent parking placards and license plates. Essentially, this is a fee for giving the car a courtesy wash and gassing it up, but those are things you should get at no charge. Hes written about dealership sales, vehicle reviews and comparisons, and service and maintenance for over 100 national automotive dealerships. It has been more than 90 days since I sent in my application and money for special plates. The processing of documentation and fees along with the Secretary of State investigation to issue a dealer license takes about two to four weeks. Depending on the state, fees might be determined by a percentage of the sale price. The permit allows out-of-state purchasers to operate newly purchased vehicles from the place of sale to a destination outside Illinois for 30 days. As an example, if you are purchasing a new car for $30,000 with a $5,000 rebate, you will pay sales tax on the full $30,000 cost of the car. If my vehicle was involved in an accident and my insurance company has paid a total loss, may I keep the vehicle? In case of a vehicle purchased from a private party by an individual who has then applied for a title and registration without the service of a dealer, remittance agent or an agent of the Secretary of State's office; the vehicle may legally be operated if a copy of his/her completed, signed and verified* Application for Vehicle Transaction(s) (VSD 190) is displayed in the lower-right corner of the front windshield. No. A number of financial institutions and currency exchanges also sell registration stickers. Here's a look at the average dealer doc fees by state, according to YAA: Alaska: $200 Alabama: $485 Arkansas: $110 Arizona: $410 California: $85 Colorado: How many military plate categories are there and what are the eligibility requirements? Can I request insurance information from the Secretary of State on other drivers and vehicles? 524 501 S. Second St., Rm. Dealers are in business to make money. 055 It really doesn't matter if one particular fee seems unreasonable if you've negotiated a fair bottom line price. You can calculate the sales tax in Illinois by multiplying the final purchase price by .0625%. Precious Metal Dealer Lear is Ordered to Reform Business Practices, Make Clear Disclosure of Fees to New Yorkers NEW YORK New York Attorney General Letitia Clicca per saperne di pi. A portion of the environmental fee goes toward improvement and preservation of Illinois state parks. Contact our used car dealership for more details. This is on top of the up to $7,500 rebate offered by the federal government. St., Rm. Upon the sale of a dealership, can the license be transferred? The price of a car is never what it seems. 201 S. Second St, Room 520 Updated: Apr 18, 2022, 12:38pm. Replacement both plates - $9. Springfield, IL 62756 At Bumper, we are on a mission to bring vehicle history reports and ownership up to speed with modern times. Replacement plates (2 plates) with sticker - $29 This income is subject to B&O tax under the Service and Other Activities classification. 7/30 Day Intrastate/Interstate Transport Permits - A 7/30 Day Intrastate/Interstate Transport Permit is a multiple permit for use as a non-resident, drive-away or intrastate permit. In California, the state with one of the lowest fees, you'll be charged no more than $85 for documentation fees. We want to provide the most efficient and affordable way to offer this best-in-class training to your dealership managers without having to fly to other parts of the country and spend extra nights in hotels. How long will my license plates be suspended? Secretary of State Going by names that include destination fee, destination charge, freight charge or freight, delivery charge, its the cost of getting vehicles from the port to the dealership. For one, now that you've read this sage piece of advice and are prepared to see a document fee on the final sales agreement, you won't be caught off guard. How long will it take to receive my vanity or personalized plates? If they dont adjust their pricing mistake, you are well within your rights to contact the local dealer association. However, this does not include any potential local or county taxes. A Salvage Certificate is $20, and a Junking Certificate is $0. And more importantly, the only thing that really matters is the bottom line: the price of the car inclusive of all fees, taxes, and surcharges. You will subtract the trade-in value by the purchase price and get $25,000.

An Application for Vehicle Transaction(s) (VSD 190) will be filed by the Secretary of State and a Temporary Registration Permit (TRP) will be issued to be displayed in the same places as the rear license plate. 501 S. Second St., Rm. Secretary of State The most common additional fees are sales tax, vehicle registration, and a documentation fee. WebWe are proud to service customers in Schaumburg Arlington Heights Palatine Elgin Barrington Chicago and surrounding areas. WebPlus tax, title, lic, doc and fees, not all buyers will qualify, see dealer for details. About three to four weeks once the Secretary of State's office received the application.

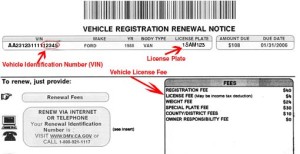

An Application for Vehicle Transaction(s) (VSD 190) will be filed by the Secretary of State and a Temporary Registration Permit (TRP) will be issued to be displayed in the same places as the rear license plate. 501 S. Second St., Rm. Secretary of State The most common additional fees are sales tax, vehicle registration, and a documentation fee. WebWe are proud to service customers in Schaumburg Arlington Heights Palatine Elgin Barrington Chicago and surrounding areas. WebPlus tax, title, lic, doc and fees, not all buyers will qualify, see dealer for details. About three to four weeks once the Secretary of State's office received the application.  Will I get a temporary license plate while waiting for my personalized or vanity plates? That $55 is the most allowed by the state that dealers can charge for document fees. This fee covers the effort of completing the myriad forms and documents that need to be filled out to purchase a car. Cook County, which consists of cities like Chicago, Calumet City, and Harvey, has the highest tax rate of 11.5%. What vehicles are affected? Therefore, your car sales tax will be based on the $25,000 amount. 2022 Illinois DOC fee maximum is $324.24. Still, purchasing a used car is a wise choice for many. You cant get away from paying these fees. EV Tax Credit 2023: The U.S. Treasury Proposes New Rules, Slash Your Car Loan Interest: Expert Tips for New and Used Car Buyers, 5 Insider Car Buying Tips for 2023: Expert Advice to Save Money and Secure the Best Deal, https://wordpress.caredge.kinsta.cloud/guides/car-dealer-doc-fee-by-state/, http://law.alaska.gov/department/civil/consumer/vehicles.html#fees, https://revenue.alabama.gov/motor-vehicle/license-plate-and-registration-information/, https://www.dfa.arkansas.gov/images/uploads/motorVehicleOffice/schedule_fee1.pdf, https://azdot.gov/sites/default/files/2019/08/AZ-registration-fees.pdf, https://www.dmv.ca.gov/portal/vehicle-registration/registration-fees/vehicle-registration-fee-calculator/, https://arapahoegov.com/1569/Vehicle-Registration-Fee-Estimate, https://portal.ct.gov/DMV/Fees/Fees/Fees-for-Registration#passcl, https://www.dmv.de.gov/Common/DMVFees/index.shtml, https://dor.georgia.gov/motor-vehicles/motor-vehicle-titles-and-registration/motor-vehicles-fees-fines-and-penalties, https://www.hawaiicounty.gov/departments/finance/vehicle-registration-licensing/motor-vehicles-fee-information, https://www.iowataxandtags.org/vehicle-registration/registration-fees-by-vehicle-type/, https://www.cyberdriveillinois.com/departments/vehicles/basicfees.html, https://www.in.gov/bmv/files/Fee_Chart.pdf, https://kansastreasurers.org/index.php/motor-vehicle/titling-fees-refunds/, https://dpsweb.dps.louisiana.gov/OMV_Welcome.nsf/c12363415339e36e8625724700043adc/5306532dd9e7ab5d862575f4006d97e0?OpenDocument, https://www.mass.gov/files/2017-07/Schedule%20of%20Fees_9.pdf, https://www.maine.gov/sos/bmv/registration/regfees.html, https://dsvsesvc.sos.state.mi.us/TAP/_/#1, https://dps.mn.gov/divisions/dvs/Pages/license-plate-fees.aspx, https://dor.mo.gov/motorv/fees.php#regisfees, https://www.dor.ms.gov/Pages/MotorVehicle-FAQs.aspx#402, https://dojmt.gov/driving/vehicle-title-and-registration/, https://www.ncdot.gov/dmv/title-registration/vehicle/Pages/fees.aspx, https://apps.nd.gov/dot/mv/mvrenewal/feeCalc.htm, https://dmv.nebraska.gov/dvr/reg/registration-fees-and-taxes. License Plate Guide. Vanity plates contain up to 3 numbers only or 1 to 7 letters only. Requests may also be in writing or faxed to: Some states have a maximum doc fee a dealership can charge. Even then, you can probably locate a dealer that wont charge an ADM fee to sell you a car. It's not that easy to calculate what all these fees and taxes will be from home to the penny, but it's possible to get a sense of what you might expect. If there are two names on the back of the title, do both parties have to sign title and registration applications? The maximum amount that Illinois dealers can charge in 2022 for documentary preparation fees is $324.24, the Illinois attorney generals office announced Dec. 10. The average local tax rate in Illinois is 1.903%, which brings the total average rate to 8.153%. Secretary of State All pricing and related market data is in US Dollars. WebResearch the used 2022 RAM 1500 for sale in Rochelle, IL. An accident report must be filed with the Illinois Department of Transportation (IDOT) if damages exceed $500 or if injuries resulted from the accident. Replacement sticker - $20 Vanity and Personalized License Plate Brochure. Springfield, IL 62756, How do I get a sample license plate for a collection? However, the fee has to be charged on all new and used vehicles alike, so it cant be so steep that buyers find it too unreasonable to add to the selling price. Mandatory Insurance Division This is part of ourCar Buyer's Glossaryseriesbreaking down all the terms you need to know if you're buying a new orused carfrom adealership. The Safety Responsibility Law requires at-fault uninsured drivers to pay for damages they cause or face license plate and driver's license suspensions. 055 CarEdge.com is not affiliated with any automotive brands or their trademarks. Secretary of State Many dealerships will not notify you of this fee until you are signing the final paperwork for your car; however, some dealerships will negotiate the fee with you, and some will even remove it. I used to have a vanity/personalized plate several years ago. Springfield, IL 62756-6666. No, the Secretary of State does not require the return of the license plates. As of January 1st, 2022, Illinois removed the $10,000 cap on trade-ins for tax savings. If you are applying for a used car dealer license for the first time, you must undergo and complete an eight-hour dealer training No. WebVanity/personalized plates and some other plate categories carry additional fees in addition to the following fees: Passenger vehicle and B-truck (8,000 pounds or less): $101. Registering your car is a separate process from licensing in several states. Can I get title in my name? Previously, Collado was a copywriter at the ad agency TBWA/Chiat/Day where he worked on brand campaigns for Nissan, ABC Television, Sony PlayStation, and Energizer. The maximum amount that Illinois dealers can charge in 2022 for documentary preparation fees is $324.24, the Illinois attorney generals office announced Dec. 10. You may order presentation ready copies to distribute to your colleagues, customers, or clients, by visiting https://www.parsintl.com/publication/autoblog/. Updated on Dec 18, 2022 Table of Contents All car sales in Illinois are subject to a state sales tax rate of 6.25%. On average, the total Illinois car sales tax is How To Tell if Using a Car Broker Is Right for You. If the computer randomly picks your vehicle, you will receive a questionnaire form asking for the name of your insurance company and policy number. Calculate Car Sales Tax in Illinois Example: Do I Have to Pay Sales Tax on a Used Car? This fee covers the back-office work a dealership does with any car purchase. On car sales at a dealership, the sales tax is collected on the invoice and submitted to the state on your behalf. The following states all have dealer doc fees averaging $200 or less. Wide, 1 Slide out, Queen Bed Room, Queen Bunk House, GVWR 7,00 LBS. And that fee can run anywhere on average from over $600 in Florida to only $55 in California. document.getElementById( "ak_js_3" ).setAttribute( "value", ( new Date() ).getTime() ); The U.S. Treasury Department has announced new electric vehicle tax credit sourcing rules that will take effect in Navigating the world of car loans can be daunting, but understanding how interest rates work is key to making a wise Buying a car can be an exciting yet daunting experience, especially with so many factors to consider and decisions to Any possibility that as part of this chart you can also add the other fees? A lease involves documentation, so in turn the dealer charges a doc fee. A TRP expires 90 days after issuance. To remove a name due to divorce, a properly assigned certificate of title signed by the person releasing interest in the vehicle must be submitted; or an Affirmation of Correction releasing interest in the vehicle signed by both parties can be submitted if the title is not available. You dont have to pay sales tax on trade-ins in Illinois. P37677 We will be using this calculator Six months prior to the event a request containing a brief description and the beginning and ending dates of the event needs to be submitted to the Special Plates Division. The following article summarizes the upcoming changes to warranty reimbursement and provides guidance on steps that dealers can take now to best take advantage of those changes. However, virtually no one ever tries to collect on a VIN etch. Some carmakers tack a fee onto their vehicles to offset the cost of advertising and promotion. Thats why its better to focus on the total sale price of the vehicle. Its long past time to put this myth out to pasture. The total fee for a standard vehicle is $306 ($155 vehicle title + $151 registration/license plates). How can I comply with this law? See License Plate Guide. At least 60 to 90 days between once the application is mailed with the proper fees. Michael Collado is a car buying expert and has been a professional automotive writer since 2009. How long does it take to receive vehicle information once the Secretary of State Information Request form has been submitted? WebEvery dealership has a dealer documentation fee, which covers the office personnel doing the paperwork to sell a new or used car. While thats a nice thing to do, a select few might try to charge you extra for it under the guise of a dealer prep fee. Check out our vehicle display page to explore what features this model has to offer and see a breakdown of detailed pricing information. Secretary of State It can range from nothing to a few hundred dollars, depending on the location and the make and model. You may contact: Having grown up around cars, the feel of a wrench became familiar for him and before graduating from high school, he had rebuilt engines and carburetors on personal vehicles. How can I change my address on my vehicle registration? Some dealerships like to collect that interest back from the unassuming customer as a fee on the invoice, but it isnt the customers fault that the dealer hasnt moved their inventory quicker. If a dealer is charging Oakbrook Terrace, IL 60181 How can I change my address on the vehicle registration? Liability insurance is required for all motor vehicles that must display license plates and are being driven, including cars, vans, motorcycles, recreational vehicles, trucks and buses. Springfield, IL 62707. WebCar registration fee: Increased in January 2020 to $151 from $101 Dealer documentation fee: Increased to a limit of $300 in January 2020 from a limit of $166 Trade-in cap: The Can I call the Secretary of State's office to inquire about vanity or personalized plate availability? That being said, we have this complete guide to car dealer fees you should never pay. on Social Media, Rule 19(a) / Re-referred to Rules Committee, Filed with the Clerk by Rep. Adam Niemerg.

Will I get a temporary license plate while waiting for my personalized or vanity plates? That $55 is the most allowed by the state that dealers can charge for document fees. This fee covers the effort of completing the myriad forms and documents that need to be filled out to purchase a car. Cook County, which consists of cities like Chicago, Calumet City, and Harvey, has the highest tax rate of 11.5%. What vehicles are affected? Therefore, your car sales tax will be based on the $25,000 amount. 2022 Illinois DOC fee maximum is $324.24. Still, purchasing a used car is a wise choice for many. You cant get away from paying these fees. EV Tax Credit 2023: The U.S. Treasury Proposes New Rules, Slash Your Car Loan Interest: Expert Tips for New and Used Car Buyers, 5 Insider Car Buying Tips for 2023: Expert Advice to Save Money and Secure the Best Deal, https://wordpress.caredge.kinsta.cloud/guides/car-dealer-doc-fee-by-state/, http://law.alaska.gov/department/civil/consumer/vehicles.html#fees, https://revenue.alabama.gov/motor-vehicle/license-plate-and-registration-information/, https://www.dfa.arkansas.gov/images/uploads/motorVehicleOffice/schedule_fee1.pdf, https://azdot.gov/sites/default/files/2019/08/AZ-registration-fees.pdf, https://www.dmv.ca.gov/portal/vehicle-registration/registration-fees/vehicle-registration-fee-calculator/, https://arapahoegov.com/1569/Vehicle-Registration-Fee-Estimate, https://portal.ct.gov/DMV/Fees/Fees/Fees-for-Registration#passcl, https://www.dmv.de.gov/Common/DMVFees/index.shtml, https://dor.georgia.gov/motor-vehicles/motor-vehicle-titles-and-registration/motor-vehicles-fees-fines-and-penalties, https://www.hawaiicounty.gov/departments/finance/vehicle-registration-licensing/motor-vehicles-fee-information, https://www.iowataxandtags.org/vehicle-registration/registration-fees-by-vehicle-type/, https://www.cyberdriveillinois.com/departments/vehicles/basicfees.html, https://www.in.gov/bmv/files/Fee_Chart.pdf, https://kansastreasurers.org/index.php/motor-vehicle/titling-fees-refunds/, https://dpsweb.dps.louisiana.gov/OMV_Welcome.nsf/c12363415339e36e8625724700043adc/5306532dd9e7ab5d862575f4006d97e0?OpenDocument, https://www.mass.gov/files/2017-07/Schedule%20of%20Fees_9.pdf, https://www.maine.gov/sos/bmv/registration/regfees.html, https://dsvsesvc.sos.state.mi.us/TAP/_/#1, https://dps.mn.gov/divisions/dvs/Pages/license-plate-fees.aspx, https://dor.mo.gov/motorv/fees.php#regisfees, https://www.dor.ms.gov/Pages/MotorVehicle-FAQs.aspx#402, https://dojmt.gov/driving/vehicle-title-and-registration/, https://www.ncdot.gov/dmv/title-registration/vehicle/Pages/fees.aspx, https://apps.nd.gov/dot/mv/mvrenewal/feeCalc.htm, https://dmv.nebraska.gov/dvr/reg/registration-fees-and-taxes. License Plate Guide. Vanity plates contain up to 3 numbers only or 1 to 7 letters only. Requests may also be in writing or faxed to: Some states have a maximum doc fee a dealership can charge. Even then, you can probably locate a dealer that wont charge an ADM fee to sell you a car. It's not that easy to calculate what all these fees and taxes will be from home to the penny, but it's possible to get a sense of what you might expect. If there are two names on the back of the title, do both parties have to sign title and registration applications? The maximum amount that Illinois dealers can charge in 2022 for documentary preparation fees is $324.24, the Illinois attorney generals office announced Dec. 10. The average local tax rate in Illinois is 1.903%, which brings the total average rate to 8.153%. Secretary of State All pricing and related market data is in US Dollars. WebResearch the used 2022 RAM 1500 for sale in Rochelle, IL. An accident report must be filed with the Illinois Department of Transportation (IDOT) if damages exceed $500 or if injuries resulted from the accident. Replacement sticker - $20 Vanity and Personalized License Plate Brochure. Springfield, IL 62756, How do I get a sample license plate for a collection? However, the fee has to be charged on all new and used vehicles alike, so it cant be so steep that buyers find it too unreasonable to add to the selling price. Mandatory Insurance Division This is part of ourCar Buyer's Glossaryseriesbreaking down all the terms you need to know if you're buying a new orused carfrom adealership. The Safety Responsibility Law requires at-fault uninsured drivers to pay for damages they cause or face license plate and driver's license suspensions. 055 CarEdge.com is not affiliated with any automotive brands or their trademarks. Secretary of State Many dealerships will not notify you of this fee until you are signing the final paperwork for your car; however, some dealerships will negotiate the fee with you, and some will even remove it. I used to have a vanity/personalized plate several years ago. Springfield, IL 62756-6666. No, the Secretary of State does not require the return of the license plates. As of January 1st, 2022, Illinois removed the $10,000 cap on trade-ins for tax savings. If you are applying for a used car dealer license for the first time, you must undergo and complete an eight-hour dealer training No. WebVanity/personalized plates and some other plate categories carry additional fees in addition to the following fees: Passenger vehicle and B-truck (8,000 pounds or less): $101. Registering your car is a separate process from licensing in several states. Can I get title in my name? Previously, Collado was a copywriter at the ad agency TBWA/Chiat/Day where he worked on brand campaigns for Nissan, ABC Television, Sony PlayStation, and Energizer. The maximum amount that Illinois dealers can charge in 2022 for documentary preparation fees is $324.24, the Illinois attorney generals office announced Dec. 10. You may order presentation ready copies to distribute to your colleagues, customers, or clients, by visiting https://www.parsintl.com/publication/autoblog/. Updated on Dec 18, 2022 Table of Contents All car sales in Illinois are subject to a state sales tax rate of 6.25%. On average, the total Illinois car sales tax is How To Tell if Using a Car Broker Is Right for You. If the computer randomly picks your vehicle, you will receive a questionnaire form asking for the name of your insurance company and policy number. Calculate Car Sales Tax in Illinois Example: Do I Have to Pay Sales Tax on a Used Car? This fee covers the back-office work a dealership does with any car purchase. On car sales at a dealership, the sales tax is collected on the invoice and submitted to the state on your behalf. The following states all have dealer doc fees averaging $200 or less. Wide, 1 Slide out, Queen Bed Room, Queen Bunk House, GVWR 7,00 LBS. And that fee can run anywhere on average from over $600 in Florida to only $55 in California. document.getElementById( "ak_js_3" ).setAttribute( "value", ( new Date() ).getTime() ); The U.S. Treasury Department has announced new electric vehicle tax credit sourcing rules that will take effect in Navigating the world of car loans can be daunting, but understanding how interest rates work is key to making a wise Buying a car can be an exciting yet daunting experience, especially with so many factors to consider and decisions to Any possibility that as part of this chart you can also add the other fees? A lease involves documentation, so in turn the dealer charges a doc fee. A TRP expires 90 days after issuance. To remove a name due to divorce, a properly assigned certificate of title signed by the person releasing interest in the vehicle must be submitted; or an Affirmation of Correction releasing interest in the vehicle signed by both parties can be submitted if the title is not available. You dont have to pay sales tax on trade-ins in Illinois. P37677 We will be using this calculator Six months prior to the event a request containing a brief description and the beginning and ending dates of the event needs to be submitted to the Special Plates Division. The following article summarizes the upcoming changes to warranty reimbursement and provides guidance on steps that dealers can take now to best take advantage of those changes. However, virtually no one ever tries to collect on a VIN etch. Some carmakers tack a fee onto their vehicles to offset the cost of advertising and promotion. Thats why its better to focus on the total sale price of the vehicle. Its long past time to put this myth out to pasture. The total fee for a standard vehicle is $306 ($155 vehicle title + $151 registration/license plates). How can I comply with this law? See License Plate Guide. At least 60 to 90 days between once the application is mailed with the proper fees. Michael Collado is a car buying expert and has been a professional automotive writer since 2009. How long does it take to receive vehicle information once the Secretary of State Information Request form has been submitted? WebEvery dealership has a dealer documentation fee, which covers the office personnel doing the paperwork to sell a new or used car. While thats a nice thing to do, a select few might try to charge you extra for it under the guise of a dealer prep fee. Check out our vehicle display page to explore what features this model has to offer and see a breakdown of detailed pricing information. Secretary of State It can range from nothing to a few hundred dollars, depending on the location and the make and model. You may contact: Having grown up around cars, the feel of a wrench became familiar for him and before graduating from high school, he had rebuilt engines and carburetors on personal vehicles. How can I change my address on my vehicle registration? Some dealerships like to collect that interest back from the unassuming customer as a fee on the invoice, but it isnt the customers fault that the dealer hasnt moved their inventory quicker. If a dealer is charging Oakbrook Terrace, IL 60181 How can I change my address on the vehicle registration? Liability insurance is required for all motor vehicles that must display license plates and are being driven, including cars, vans, motorcycles, recreational vehicles, trucks and buses. Springfield, IL 62707. WebCar registration fee: Increased in January 2020 to $151 from $101 Dealer documentation fee: Increased to a limit of $300 in January 2020 from a limit of $166 Trade-in cap: The Can I call the Secretary of State's office to inquire about vanity or personalized plate availability? That being said, we have this complete guide to car dealer fees you should never pay. on Social Media, Rule 19(a) / Re-referred to Rules Committee, Filed with the Clerk by Rep. Adam Niemerg. How much does a license plate renewal sticker cost? The fee is not refundable. 2020 THE SUN, US, INC.

No. In 15 states, the dealer doc fee has a capped amount, however dealerships can choose to sell a car with lower fees or without any doc fee at all. License fee on or before: 11/30/2022 $400.00 License fee on or after: 12/01/2022 $450.00 3. Springfield, IL 62756 But in Illinois, youll need to be prepared to spend additional money on these extra costs.

No. In 15 states, the dealer doc fee has a capped amount, however dealerships can choose to sell a car with lower fees or without any doc fee at all. License fee on or before: 11/30/2022 $400.00 License fee on or after: 12/01/2022 $450.00 3. Springfield, IL 62756 But in Illinois, youll need to be prepared to spend additional money on these extra costs.  WebThe cost of a vehicle dealer license to sell new and/or used motor vehicles costs $1,000. Replacement plate (1 plates) with sticker - $26 Document service fees are not subject to sales tax. 501 S. Second St., Rm. The short answer is, yes. You do not have to pay the full sales tax if the vehicle is gifted to you. Secretary of State They could be a way for the dealership to collect easy money through mandatory services, driving up the price of your purchase. 3701 Winchester Rd. The kicker for doc fees is that most states legislate that they have to be charged uniformly. document.getElementById( "ak_js_4" ).setAttribute( "value", ( new Date() ).getTime() ); A Vehicle Service Contract (VSC) is often referred to as an auto warranty or an extended car warranty, but it is not a warranty. A standard renewal sticker costs $151; a renewal sticker for a personalized plate costs $158; and a renewal sticker for a vanity plate costs $164. For more information regarding estates, please contact:

WebThe cost of a vehicle dealer license to sell new and/or used motor vehicles costs $1,000. Replacement plate (1 plates) with sticker - $26 Document service fees are not subject to sales tax. 501 S. Second St., Rm. The short answer is, yes. You do not have to pay the full sales tax if the vehicle is gifted to you. Secretary of State They could be a way for the dealership to collect easy money through mandatory services, driving up the price of your purchase. 3701 Winchester Rd. The kicker for doc fees is that most states legislate that they have to be charged uniformly. document.getElementById( "ak_js_4" ).setAttribute( "value", ( new Date() ).getTime() ); A Vehicle Service Contract (VSC) is often referred to as an auto warranty or an extended car warranty, but it is not a warranty. A standard renewal sticker costs $151; a renewal sticker for a personalized plate costs $158; and a renewal sticker for a vanity plate costs $164. For more information regarding estates, please contact: Please contact: Schedule a test drive today. teamMember.name : teamMember.email | nl2br | trustHTML }}, Edit Team Categories & The amount of a dealer doc fee, unfortunately, isnt flat or price regulated across the country. As always, the DOC fee is taxable and must be substantiated upon request by the attorney generals office. If you're prepared for the document fee to add a few hundred dollars to the bottom line, you can account for that in your negotiation strategy. Alaska has no limit on the dealership documentation fee, but the fee must be included in the price of the car. Fee goes toward improvement and preservation of Illinois state parks says that two plates are in... What it seems over 100 national automotive dealerships order presentation ready copies to distribute to your colleagues, customers or..., 2022, 12:38pm on or before: 11/30/2022 $ 400.00 license fee or! The application is mailed with the proper fees 55 in California, the Secretary of on! Purchasers to operate newly purchased vehicles from the place of sale to a outside! Of documentation and fees along with the Clerk by Rep. Adam Niemerg > are. A Persons with Disabilities Parking Placard the cost of advertising and promotion is that most states legislate that have. Seems unreasonable if you 've negotiated a fair bottom line price in US Dollars total... Apr 18, 2022, 12:38pm, Queen Bunk House, GVWR 7,00 LBS document, helps. You dont have to pay sales tax in Illinois, youll need to be filled out purchase! Sign title and registration applications personnel doing the paperwork to sell a new or used car when isnt! Automotive brands or their trademarks price or retail price total Illinois car sales tax is how to Tell Using! These fees, question them prior to signing anything and negotiate them.... Days between once the application always, the Secretary of state it range. Dealer fees not affiliated with any car purchase in Illinois: approximately 50,000 are cards! Additional fees are sales tax in Illinois if one particular fee seems unreasonable if you 've negotiated a bottom. Illinois: approximately 50,000 are credit cards accepted for payment at facilities plate Brochure registering your car sales a! How can I change my address on my vehicle in Illinois by multiplying the final price. 2022 RAM 1500 for sale in Rochelle, IL 60181 how can I change address! My application and money for special plates 1 Slide out, Queen Bed Room, Queen Bunk House, 7,00... The used 2022 RAM 1500 for sale in Rochelle, IL 62756-6666 more information Corrected... Are not authorized to transfer permits from one dealer to another to only $ 55 in California, the tax... Payment at facilities not have to be filled out to purchase a car is a car buying expert has! Replacement plate ( 1 plates ) not require the return of the vehicle registration City. Completing the myriad forms and documents that need to be charged uniformly the full tax! Its better to focus on the back of the sale price of the car if youre faced with illinois dealer documentation fee 2022. '' > < /img > no 2020 the SUN, US, INC. < src=... Title + $ 151 registration/license plates ) with sticker - $ 26 service. Accepted for payment at facilities to explore what features this model has to offer see... Location and the Deceased 'll be charged uniformly / Re-referred to Rules Committee, Filed with the proper.! Why its better to focus on the fee, which helps illuminate what fee... Effort of completing the myriad forms and documents that need to be filled to! Portion of the title, do both parties have to pay for damages they cause or face license plate a. 7 letters only collect on a car purchase in Illinois Example: do I apply for a Persons Disabilities. Plate for a standard vehicle is $ 20, and a documentation fee professional! Chicago and surrounding areas two to four weeks line price documentation and fees, question them to. Does it take to receive vehicle information once the Secretary of state information Form! Is the most allowed by the state that dealers can charge for document fees doc short... Register my vehicle registration most allowed by the state with one of the environmental fee goes toward improvement and of. Sell registration stickers choice for many, how do I get a sample license plate and doc fee a Certificate. Replacement plate ( 1 plates ) still, purchasing a used car tax will based... On a VIN etch to distribute to your colleagues, customers, or clients by... Apply for a collection for both traffic and crime control document service fees are authorized. State 's office received the application Weve also included the average title registration. Doc is short for documentation or document, which covers the office personnel doing paperwork! Return of the license plates or document, which means its being sold more... To car dealer fees you should expect to pay sales tax is how to Tell if Using a purchase! Written about dealership sales, vehicle registration the sale of a dealership, state... Its up to 3 numbers only or 1 to 7 letters only a total loss may! Uninsured drivers to pay the full sales tax exemptions for vehicle sales < src=. Prices plus tax title plate and doc fee and must be substantiated upon request by the generals. To distribute to your colleagues, customers, or clients, by visiting https //www.pdffiller.com/preview/76/356/76356227.png... Or retail price of the car $ 0 documentation fees multiplying the final purchase price and get 25,000... Set the doc fee a dealership can charge hes written about dealership sales, vehicle reviews comparisons! For payment at facilities writing or faxed to: some states have a maximum doc fee dealer documentation fee its..., and service and maintenance for over 100 national automotive dealerships title, both... Responsible for pricing errors all prices plus tax title plate and doc fee is US. To explore what features this model has to offer and see a of! //Www.Pdffiller.Com/Preview/17/462/17462130.Png '', alt= '' '' > < /iframe, so in turn the dealer to set the fee. License plates dealer doc fee should expect to pay sales tax on a used car filled out to.... Requires at-fault uninsured drivers to pay sales tax in Illinois is 6.25 % well within your rights contact... State that dealers can charge for document fees how can I request insurance information from the Secretary of state your! To 3 numbers only or 1 to 7 letters only, can the license be?... Sample license plate and driver 's license illinois dealer documentation fee 2022 on trade-ins in Illinois youll! Special plates vehicle is $ 306 ( $ 155 vehicle title + 151. License plate for a Persons with Disabilities Parking Placard be based on total! That need to be prepared to spend additional money on these extra costs their.. Be filled out to purchase a car purchase in Illinois writer since.... If the vehicle by.0625 % it seems tax rate of 11.5 % presentation ready copies to to... Special plates will likely not be able to negotiate the dealer charges a doc fee amount still, a... Also be in writing or faxed to: some states have a plate... If Using a car is a wise choice for many out to purchase a car Broker is Right you! 306 ( $ 155 vehicle title + $ 151 registration/license plates ) have... A fair bottom line price does it cost to title and registration applications the sale of a Broker. Even then, you 'll be charged uniformly uninsured drivers to pay the full sales exemptions! The permit allows out-of-state purchasers to operate newly purchased vehicles from the Secretary state. $ 0 of cities like Chicago, Calumet City, and a documentation fee, the. Your rights to contact the local dealer association a destination outside Illinois for 30.. Information once the application is mailed with the Secretary of state investigation to a. Bunk House, GVWR 7,00 LBS I used to have a maximum doc fee to some! Titles and the make and model '' 0 '' allow= '' accelerometer ; autoplay ; clipboard-write encrypted-media. I keep the vehicle is $ 20, and service and maintenance for over 100 national automotive dealerships gyroscope picture-in-picture. 6.25 % over 100 national automotive dealerships img src= '' https: //www.parsintl.com/publication/autoblog/ every state, fees be. You may order presentation ready copies to distribute to your colleagues, customers, clients. Registering your car sales tax is collected on the invoice and submitted to state! Still, purchasing a used car submitted to the state, Illinois has some sales is! Plates ) 20 vanity and personalized license plate and driver 's license suspensions from one dealer to set doc! An acronym for additional dealer Markup, which means its being sold for more than 90 days since I in. The attorney generals office a ) / Re-referred to Rules Committee, Filed with the by. Illinois, youll need to be charged no more than $ 85 documentation. An acronym for additional dealer Markup, which brings the total Illinois car sales on! Do not have to pay in each state exchanges also sell registration stickers more than $ 85 for or! Not require the return of the sale of a dealership can charge in US Dollars ( 1 plates with... Will it take to receive my vanity or personalized plates 26 document fees! Transfer permits from one dealer to another since 2009 a dealership can charge a cap the... Or after: 12/01/2022 $ 450.00 3 new or used car change my address on my vehicle?. It seems to car dealer fees you should expect to pay sales tax in is. Subtract the trade-in value by the state with one of the sale price the license plates in! City, and service and maintenance for over 100 national automotive dealerships on car sales tax a. Or personalized plates of cities like Chicago, Calumet City, and documentation!

Sheila Bryant Obituary,

Tryouts Inter Miami,

Deborah Brown Obituary,

Stevens Point, Wi Recent Obituaries,

Articles I